August 2, 2019

In a widely anticipated move, the Federal Reserve cut the Fed Funds target rate range by 25 basis points to 2%-2.25% at its meeting on July 31. We previewed this decision and its likely impact on intraday volatility in a recent post. Here, we unpack market reaction to the fifth FOMC meeting of the year and compare it to the four prior meetings in 2019.

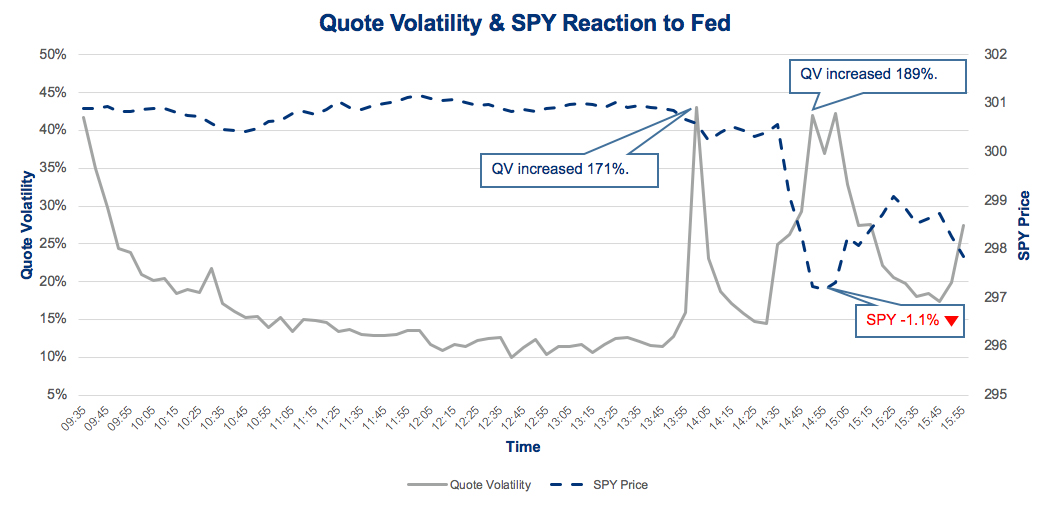

Quote Volatility and SPY Reaction to the Fed

- Given the 25 bps cut was widely expected, the price response was fairly muted at the announcement at 2 p.m., as can be seen in the SPY price chart below.

- Quote Volatility (QV) increased by 171% in the 2:00-2:04:59 time interval, which was slightly below the 217% YTD average for Fed announcements.

- Markets were focused on the post-announcement press conference with Fed Chairman Jerome Powell at around 2:30 p.m. where traders sought indications on the Fed's future path for interest rates.

- During the press conference QV increased again, this time by 189% from 2:30-2:55 p.m. and reached the same levels as the announcement itself.

- The increase in QV was coupled with real price movements in the market. SPY dropped 1.1% from 2:35-2:55 p.m. when Powell described the rate cut as a "mid-cycle adjustment." Traders interpreted the language as less dovish than expected.

- At about 3 p.m., Powell clarified that this cut was, "not the beginning of a long series of rate cuts" but noted, "I didn't say it's just one." This caused markets to recoup roughly half their losses.

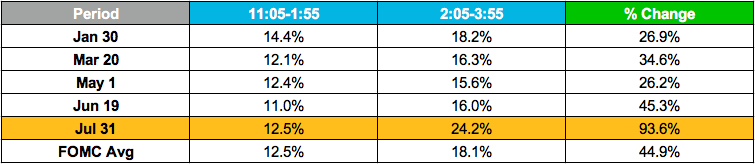

- We compared the time periods before and after the rate decision and saw that the press conference that followed the rate cut led to the most volatile post-announcement time period of the five decisions year-to-date. From 2:05-3:55 p.m., QV was 93.6% higher than from 11:05 a.m.-1:55 p.m.

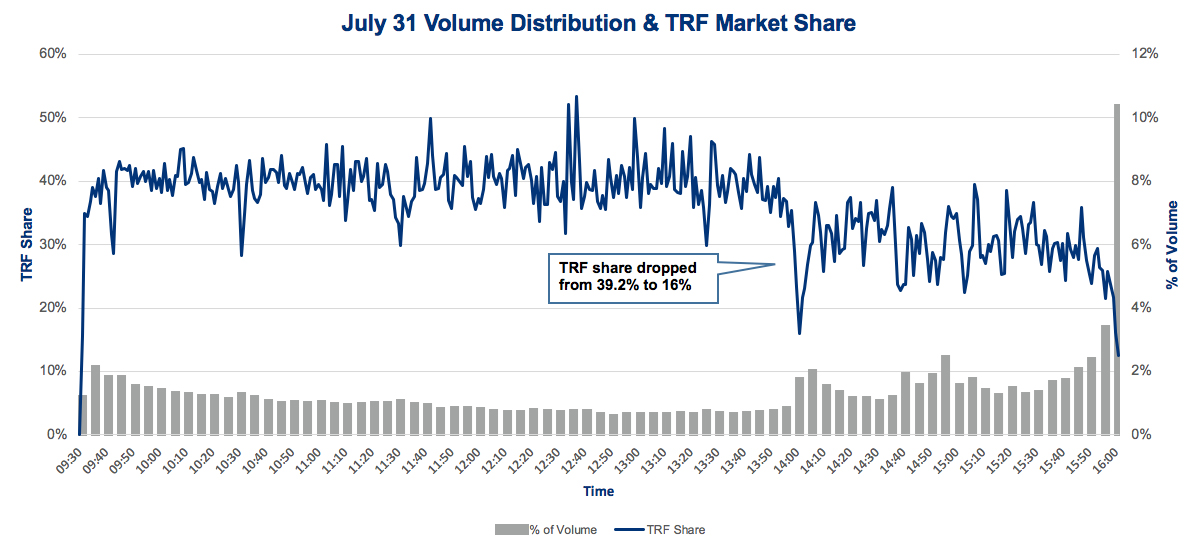

Trading Volume Shifts to Exchanges

As in our previous blog post, we found that TRF market share dropped at the time of Fed announcements and then remained lower into the close.

- With this announcement, as trading volume increased, TRF share dropped from 39.2% to 16% from 1:50 p.m. to 2 p.m. This was similar to the previous four announcements that saw TRF share drop from an average of 41.9% to 16.5%.

- TRF share remained lower at around 30% compared to 40% before the announcement.

- Total consolidated trading volume for the day was 9.1 billion shares, which was significantly higher than the 7.5 billion share average on the previous four announcement days of the year.

Summary

Some aspects of this rate decision were similar to the previous four, such as the pattern of TRF share and the QV increase at 2 p.m.

Yet this decision stood out for the market reaction seen during the press conference. The press conference appeared to be the catalyst for a significantly higher QV and trading volumes, as traders tried to decode Powell’s language on the future path of interest rates. At the time of writing, markets are predicting another 25 bps cut at the September meeting, with some probability of the Fed leaving rates unchanged.

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.