2025 Q3 Earnings Preview

Steady Hand

Straight from the trading floor

Top takeaways

- 2025 Q3 S&P 500 EPS expected to be up 8.0% YoY, the 9th consecutive quarterly increase

- Revenues estimated to be up 6.3%, the 20th consecutive quarterly increase

- Positive earnings revisions during the quarter for the first time since Q4 of 2021

- Key topics - Economic/policy uncertainty, impact of tariffs, changing demand dynamics, AI capex efficiency and monetization

- Q2 Buyback activity dropped amidst policy uncertainty but set to rebound in Q3

What will investors be listening for on Conference Calls?

Broad Economy

- As some of the uncertainty has subsided has there been a pickup in activity?

Inflation Margins

- What is the impact of tariffs? What mitigation measures have been instituted to protect margins/bottom line?

- What is the pricing strategy going forward?

Inventory/Logistics

- Have tariffs impacted inventory management?

- Where do inventory levels stand after the pull forward of demand earlier this year?

- Have supply chains been impacted by tariffs, trade negotiations or recent geopolitical events?

Labor

- Has the shift in immigration policy impacted your access to labor?

- What is the plan for headcount? Is the implementation of AI having an impact on this decision?

Finance/Capital Allocation

- Has the uncertainty impacted or delayed capital allocation decisions?

- Do recent tax changes shift how you think about capital investment versus shareholder return programs?

Financials

- What is the state of the consumer?

- Are there signs of credit deterioration in private credit or subprime?

AI

- Are you able to meet the demand for AI related products?

- What percentage of your capex/IT budget is being spent on AI related initiatives? When do you expect to see a return on this investment?

- Can you provide examples of how the AI implementation has improved efficiency or productivity?

Setting the Stage - A quick lookback at Q3

Q2 ended on a positive note as the peak of the tariff terror had subsided leaving the S&P 500 once again back at a new all-time high. The good vibes continued at the start of Q3. In just the first couple weeks the 90-day tariff reprieve was extended, Congress pushed through the One Big Beautiful Bill Act (OBBBA) extending tax cuts, averting a debt default and providing tax incentives for investment in American manufacturing and R&D and let's not forget the biggest announcement of all, the engagement of Taylor Swift and Travis Kelce.

A round of waxed sealed letters were sent by President Trump to trading partners extending the initial tariff deadlines. Despite the legality of the administration’s tariff policy being challenged in the US court system, a number of countries announced deals along with the promise of investment in US manufacturing/infrastructure easing their tariff burden. The TACO trade (Trump Always Chickens Out), that drove gains during Q2, evolved into the WACO trade (World All Came Around).

Even negotiations with China seemed to be moving in the right direction with trade teams meeting on multiple occasions. A framework for a TikTok deal had been put in place to the relief of teens around the county and Presidents Trump and Xi were expected to meet later this month. That is until the end of last week, when Beijing ramped up restrictions on rare earths and added more companies to the “Unreliable Entities List” which drew the ire of President Trump who threatened further tariffs and to cancel the upcoming meeting, though cooler heads seem to have prevailed after the weekend.

After a visit to the Federal Reserve’s construction site where President Trump offered up some renovation tips, the calls for Chair Powell’s firing subsided though “Mr. Too Late” stuck. During the quarter the Federal Reserve paved the way for an easing cycle to begin with Christopher Waller, a Fed Chair hopeful, the trailblazer. After multiple dissents at the July meeting and a weak jobs report which included large revisions, leading to the firing of the head of the BLS, the Federal Reserve began that easing cycle in September.

The Q2 earnings season turned out to be solid with management teams remaining cautious given the still looming uncertainty but acknowledging an improvement in activity as some of the policy uncertainty eased. There was some choppiness with consumer facing companies while tech was once again the big standout with guidance continuing to move higher driven by the strong AI demand.

AI infrastructure spending has increasingly been a driver of US economic activity with some economists suggesting that AI capex has added more to GDP growth than consumer spending. Q3 marked a pivotal escalation in that investment. Nvidia and OpenAI are at the center of that deal making and investment. The latter has now committed to ~$1T investment with its partners. Many of the recent announcements have included circular investments between partners bringing back some memories of the late 1990’s and raising concerns about a bubble.

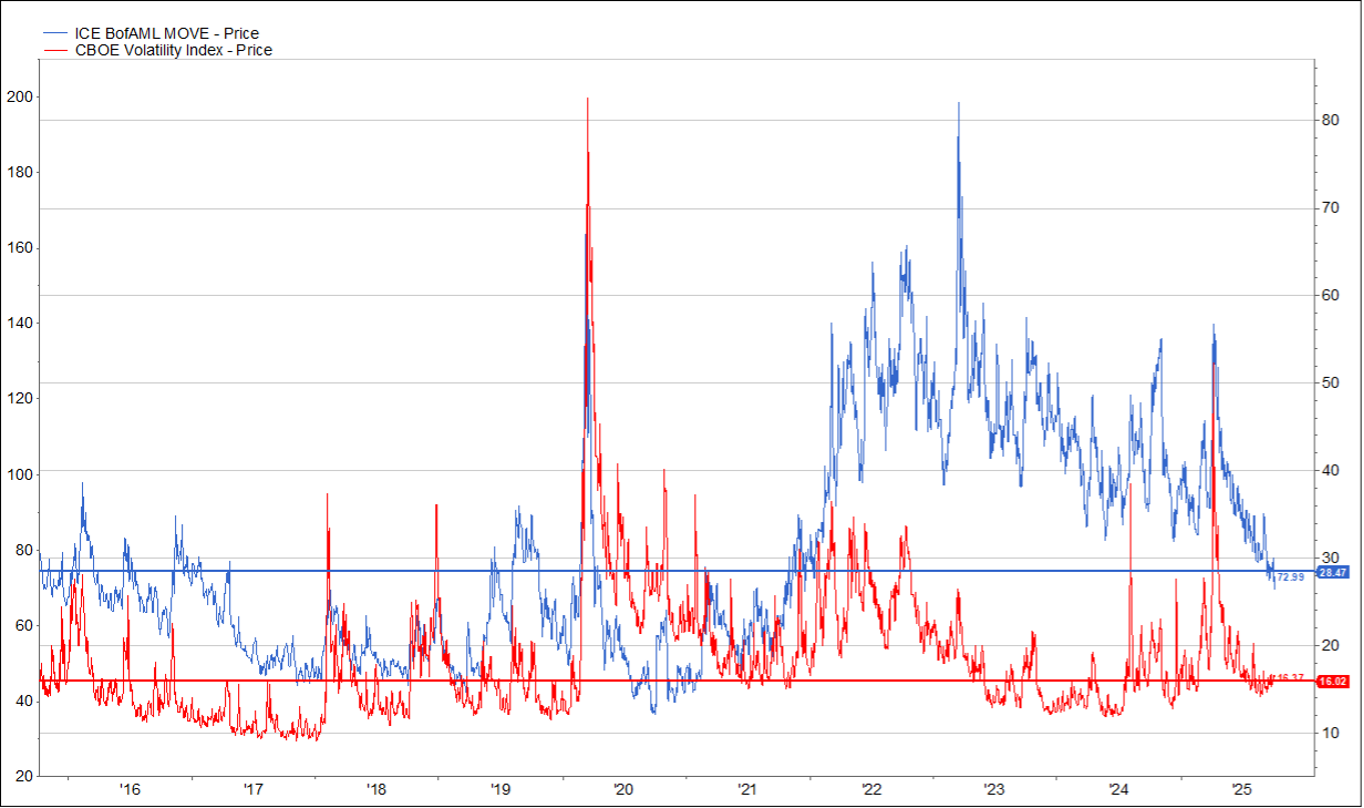

The easing of trade tensions, expectation for continued investment in AI and manufacturing, alongside an easier monetary policy regime has caused volatility to compress (see VIX/MOVE chart below), adding to the strength in asset prices.

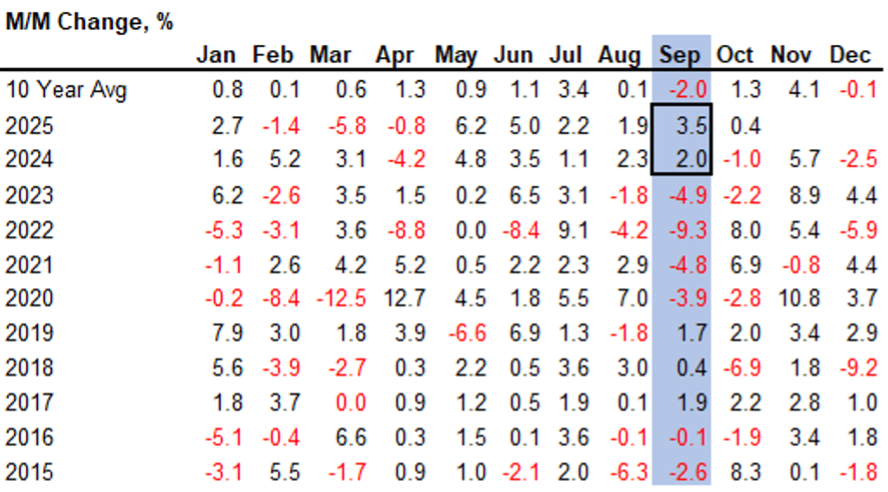

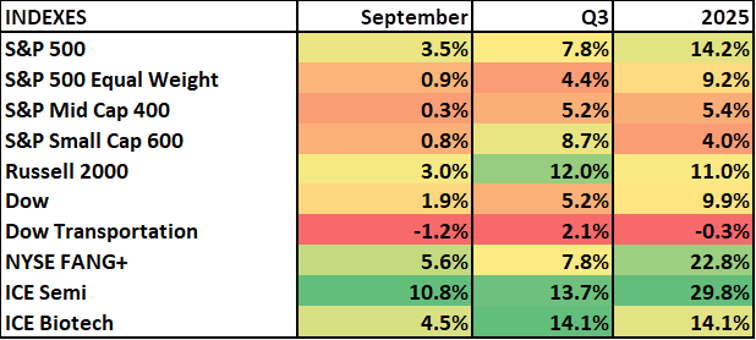

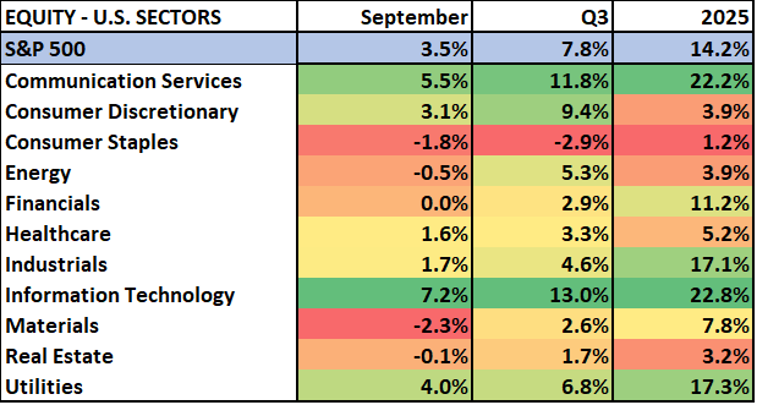

There was an unabated rally throughout Q3 with the max drawdown within the S&P 500 just over 3% during the quarter. The index closed out the quarter up nearly 8%, bucking the negative historical seasonal trends in August/September for the second consecutive year.

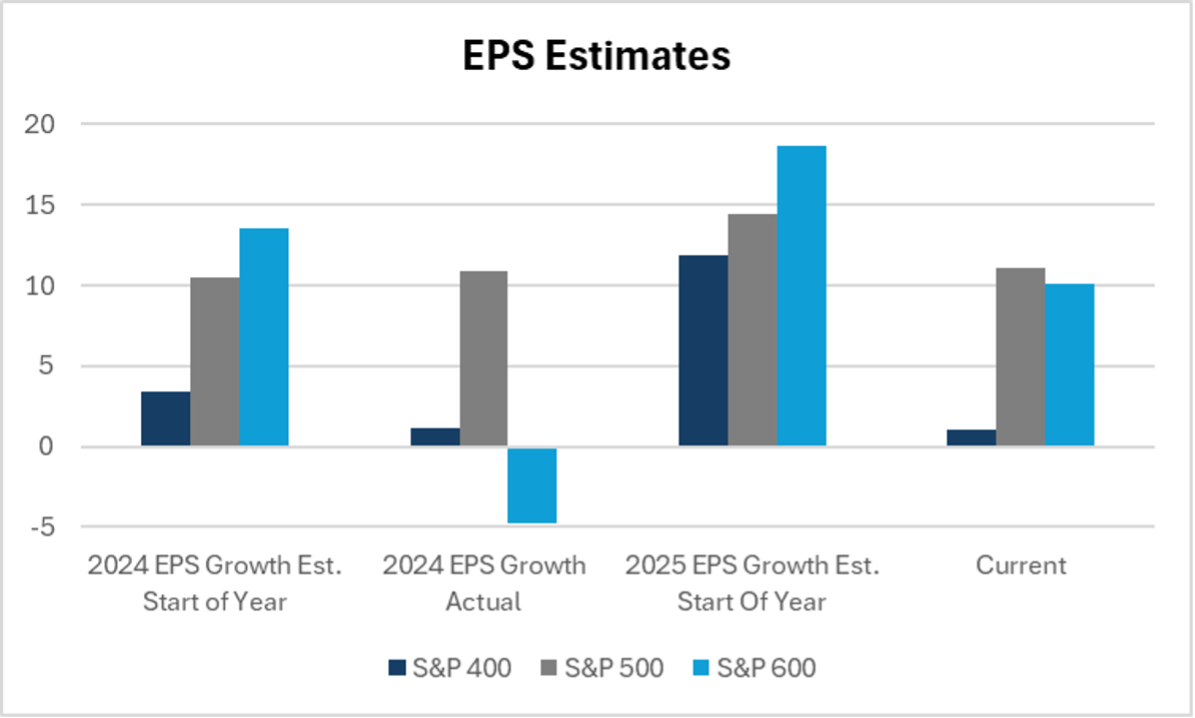

Source: FactSet

The small cap-focused Russell 2000 did even better, up 12%. The re-starting of the Fed’s rate cutting cycle was a big driver for that outperformance. Another small cap index, the S&P 600, which only includes companies that meet a profitability threshold, was up 9%. The delta between the R2K and the 600 helps show the move into riskier parts of the market, as we saw sharp rallies in some of the popular thematic trades like nuclear, quantum computing and digital asset treasury companies during the quarter.

Inside the Numbers

Data compliments of FactSet Earnings Insight as of October 10, 2025

Q2 Review

- Q2 S&P 500 earnings +11.8% YoY vs. 4.9% estimate

- 81% of companies beat analyst estimates, highest since Q3 2023

- Q2 Revenue +6.3% (vs. 4.2% est.), strongest since Q3 2022

2025 Q3 EPS Est. +8.0% YoY

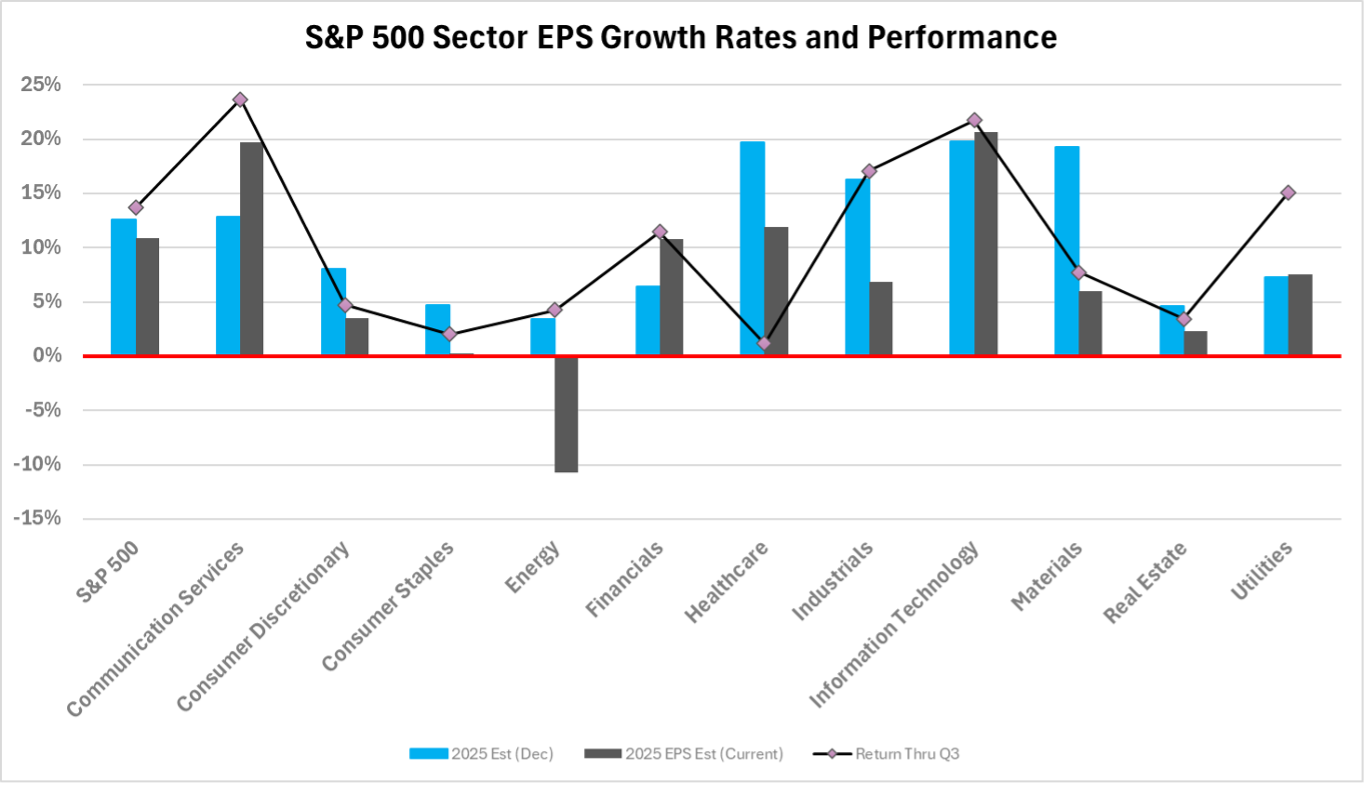

- Sectors with largest YoY growth

- Info Tech (20.9%), Utilities (17.1%), Materials (13.7%, Financials (13.2%)

- Sectors with YoY declines

- Energy (-4.2%), Consumer Staples (-3.1%), Healthcare (-1.7%), Consumer Discretionary (-1.7%)

Q3 Revenues Est. 6.3% YoY

- Largest increases: Info Tech (14.2%), Comm. Services (8.5%), Healthcare (7.9%)

- Energy (-1.8%) the only decline

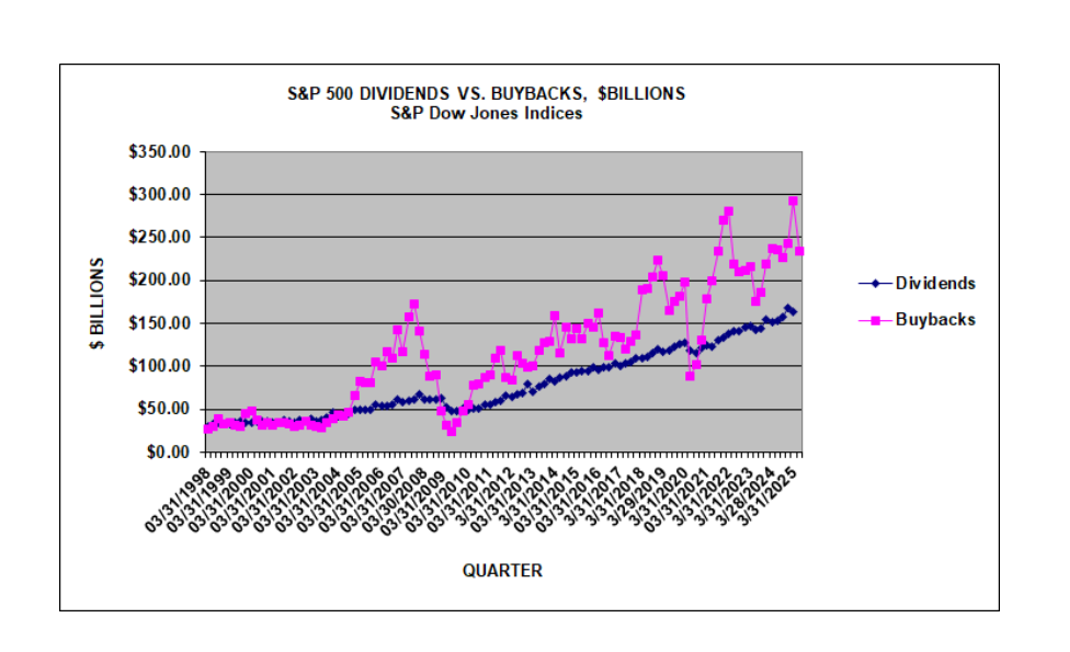

Capital return programs

Data compliments of S&P Global

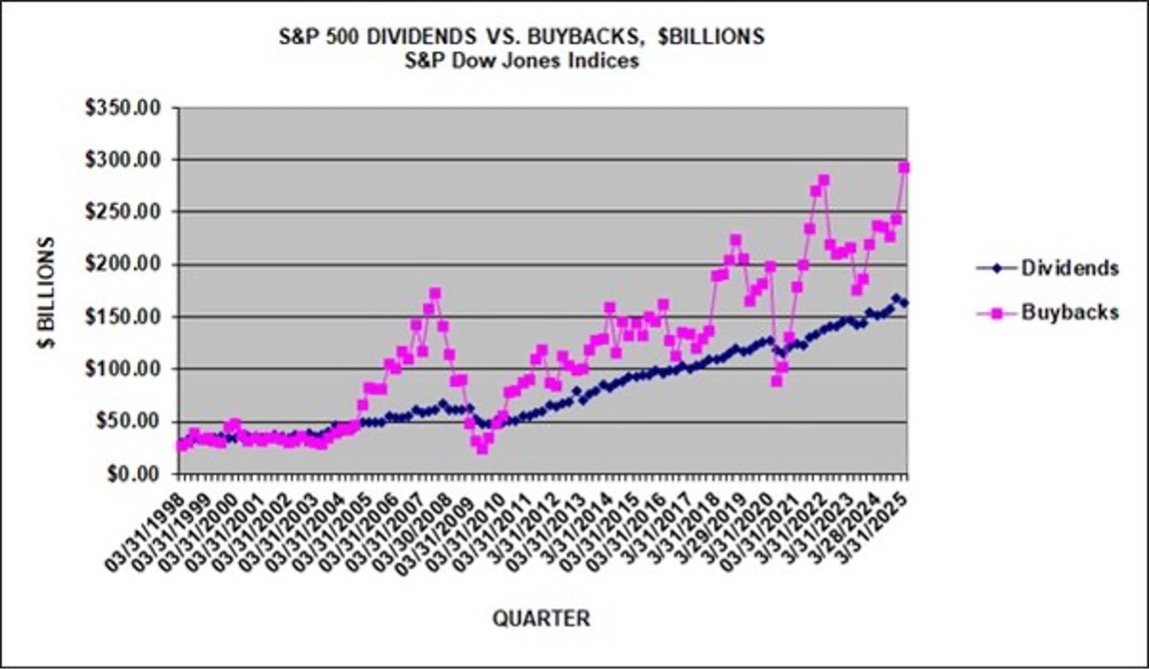

Q2 programs down 12.6% QoQ to $399.7B after Q1 record

- Q2 buybacks down 20.1% QoQ to $234.6B, amidst uncertainty

- Number of firms carrying out buybacks of at least $5ml down to 338 from 384

- Activity remains top heavy with largest 20 companies executing 51.3% of buybacks up from 48.4% in the prior quarter

The Big Picture

The Q2 earnings season began after the tariff terror had receded. Estimates had been cut heading into the reporting season and companies cleared the bar easily. The Q2 YoY growth rate was ~12% above the ~5% estimate with over 80% of companies beating numbers the highest level in over a year. Management teams continued to navigate the treacherous waters well, while noting there was improvement sequentially during the quarter as some of the policy fog began to thin. However, that fog was still thick enough to leave them treading carefully.

The strong quarterly numbers didn’t always translate into an increase in annual guidance while there were plenty of companies that tweaked Q3 guidance lower. The underlying results were somewhat uneven. Hyperscalers and other AI infrastructure spending beneficiaries put up strong results though there were some pockets of supply chain bottlenecks and margin pressure. Consumer-facing companies pointed to an overall resilient backdrop but highlighted strains in the lower income cohort. Financials were a positive standout with strong trading activity and optimism related to the pickup in investment banking and capital markets activity.

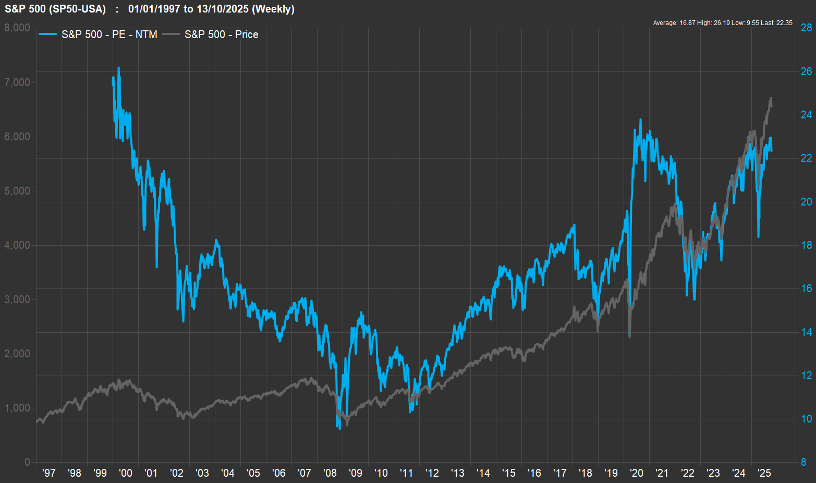

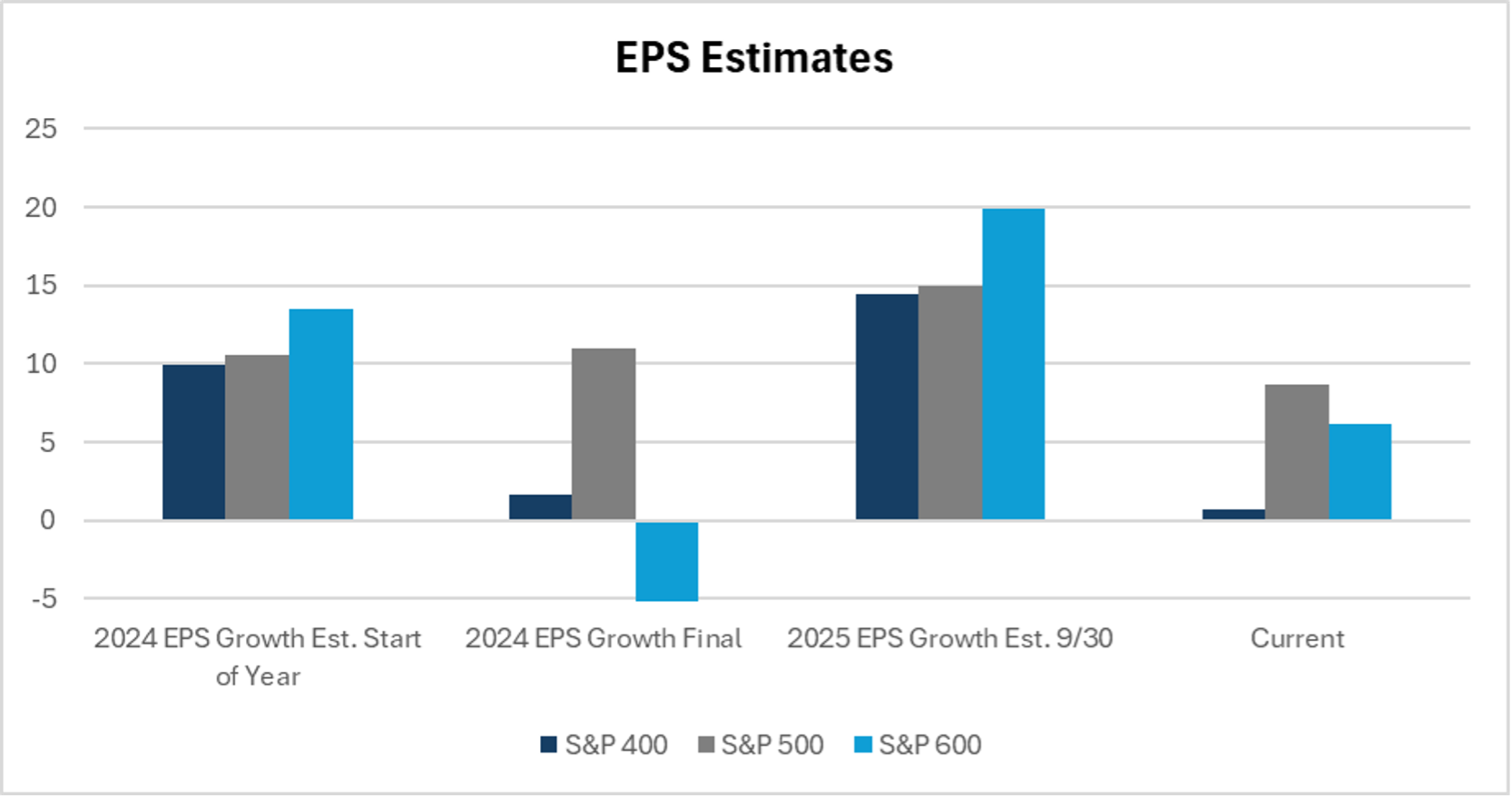

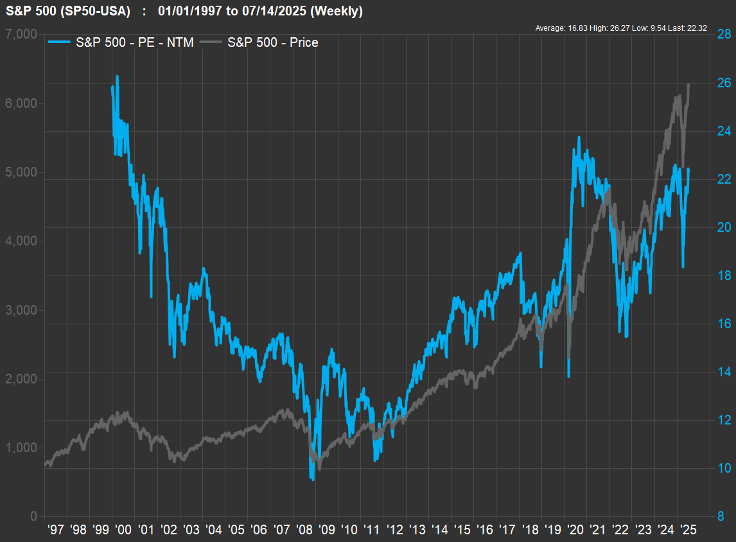

Trade tensions continued to ease throughout Q3 up until the end of last week. The backdrop heading into this quarter has been pretty sanguine with the easing of uncertainty and financial conditions. For the first time since 2021, earnings estimates have been revised up since the start of the quarter, albeit only slightly. With equity markets hovering around all-time highs and valuations getting stretched, expectations are reasonably high. There is no reason to believe that corporate America won’t continue to put up solid, but the focus will be on commentary and price action.

That commentary will take on some added importance this quarter as we are in the midst of a government shutdown, so have been without some of the key economic data for a couple of weeks. Investors will use these conferences calls to make inferences as to how the overall economy is performing. According to FactSet’s transcript analysis 142 companies in the S&P 500 discussed “layoffs” or “workforce reduction” during their conference calls. Actual layoff announcements totaled ~50k jobs (<1% of total employees) with tech companies accounting for over half of that.

The other macro theme will be pricing. Companies have done a good job of instituting mitigation measures and pulling forward demand to offset some of the impact of tariffs though there have been some high-profile companies increasing the expected drag over the last month. Last quarter margins exceeded expectations coming in at 12.8% ahead of the estimate of 12.2% coming into the quarter. Pre-tariff inventories and price increases helped in that regard. During Q2 ~13% of companies in the S&P 500 explicitly announced or discussed increasing prices with implementation expected to happen in the back half of the year. With revenues expected to be up >6% investors will try to parse out how much of that is being driven by price increases as opposed to volume growth and whether this trend will accelerate. Investors will also want to understand where we are in the destocking process.

Large companies tend to be better positioned to deal with these challenges, which along with the heavier weighting of technology, helps to explain the relative resilience of S&P 500 earnings estimates. Within the S&P 600 the relative outperformance comes versus the S&P 400 comes from tech and industrial companies levered to AI infrastructure while the latter has higher weightings of financials and consumer discretionary.

As we always highlight, financials are the first out of the gate and given their unique vantage point commentary will be important. Investors will be listening closely to perspective on consumer spending and credit trends. This quarter will be particularly interesting as the recent bankruptcies of subprime auto lender, Tricolor, and auto part company, First Brands, are reverberating through the system. Both of these bankruptcies had idiosyncratic aspects to them and losses should be reasonably well contained, but this shines a light on the growing private credit markets. With the Federal Reserve starting to cut rates there is some hope that loan growth and mortgage activity will pick up from depressed levels. The trading businesses probably won’t have a repeat of Q2, but strength in investment banking should offset that. Other interesting topics include potential changes to the regulatory environment, tokenization and the potential impact of stablecoins.

When it comes to the conversation around AI infrastructure it feels like every day, we have a new partnership or deal announced. In response to these announcements, either street estimates or official guidance has been moving higher. The street has been rewarding AI investment which has fed some of the circularity but there may not be much more to come in the short term. With the numbers expected to look exceptional, price action may be the most interesting aspect to see if stocks can hold the recent gains.

Beyond the infrastructure aspect of AI, investors are looking for more clarity about how companies are implementing the technology. Companies are at different stages of investment and implementation with investors looking to understand what is, and when there will be, a return on this investment. As well as, how that is impacting margins on both a short and long-term basis.

During Q2 amidst the uncertainty and a sharp rebound in prices companies across all sectors pulled back on their buyback programs. As some of the uncertainty has subsided, that activity is expected to pick up in the back half of the year. Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, expects the expenditures for buybacks and dividends from S&P 500 companies to “easily set a record…, posting a double-digit gain for buybacks and a mid-single-digit gain for dividends”. With some of the new corporate tax policy in the One Big Beautiful Bill Act it will be interesting to see if companies begin to shift capital allocation.

Following back-to-back >20% gains for the S&P 500 and tracking for double digit gains again this year, valuations are stretched on a historical basis with the S&P 500 trading ~25X 2025 estimates. It appears that the worst-case scenarios related to trade have been averted. The setup for corporate America going forward looks positive with easier monetary policy, expectations that the benefits of OBBBA will be felt in the coming quarters and the administration expected to increasingly shift its focus to pro-growth policies ahead of midterms. Earnings estimates reflect that optimism with analysts looking for ~14% earnings growth next year, which leaves the S&P 500 trading at a slightly less demanding 21X which is not too dissimilar as to where things stood about this time last year (~13% growth and 19X earnings).

Since 2020 one of the most impressive things has been resilience of US corporate earnings. Management teams have had a steady hand navigating through quickly evolving and often treacherous operating environments, which explains some of that valuation premium. On the eve of the official start of earnings there is no reason to believe that dynamic is about to change.

The Q1 earnings season began shortly after the peak of the tariff turmoil so it was not shocking that the number of companies in the S&P 500 citing “uncertainty” on conference calls hit the highest level since the pandemic according to FactSet’s John Butters. By the numbers it was a pretty strong reporting season with EPS up 12.9% YoY ahead of the 7% estimate. Q1 was largely B.T. (before tariffs) so this was not too surprising. However, market sentiment was very negative coming into the reporting season with some expectation that companies would begin pulling guidance. However, in fact only 8 companies in the S&P 500 withdrew guidance and only 15% of the 251 that provided guidance cut it. Management teams also did a good job of restoring some confidence highlighting increased preparedness in the wake of the pandemic, discussing operational initiatives and laying out other mitigation efforts.

As we head into the Q2 reporting season the trade uncertainty remains. After a round of negative revisions at the start of the quarter, estimates have stabilized along with the overarching sentiment. Economic data points to a pull forward of demand over the last couple of quarters, which may have been a tailwind during Q1. That dynamic may still be at play during Q2 to a lesser extent and it is still too early to see the ultimate impact of tariffs.

When looking beneath the surface of the index level earnings it is clear there are some haves and have nots. Tech continues to be the standout with mid-teens YoY earnings growth and only modest negative revisions from the start of the year. The qualitative commentary coming from the industry over the last few months has continued to be very positive, helped by the insatiable AI-related demand.

The largest negative revisions are occurring in cyclical and consumer facing sectors which are most exposed to tariffs. With the progression of news flow during the quarter I won’t be surprised if management teams suggest there was some improvement sequentially. understand evolving demand dynamics.

Margin preservation will once again be the hot topic. Last quarter net profit margins came in ahead of estimates at 12.7% (vs. 12.1%) but is expected to fall back to 12.2% this quarter which is inline with the average over the last year and above the 5yr average (11.8%). The build up of inventories will likely help to offset some of the pressures in the near-term while other mitigation measures and price increases are put into place suggesting that any compression will play out gradually over time. Large companies tend to be better positioned to deal with these challenges, which along with the heavier weighting of technology, helps to explain the relative resilience of S&P 500 earnings estimates. How companies manage supply chains, inventories and plans for pricing are all areas of interest.

Financials are the first out of the gate and given their unique vantage point commentary will be important. Investors will be listening closely for perspective on consumer spending and credit trends. There is some hope that loan growth could begin to pick up though mortgage activity remains depressed. The trading businesses likely continued to perform well, and capital markets activity improved in the back half of the quarter. It will also be interesting to hear management teams talk about potential changes to the regulatory environment, tokenization and the potential impact of stablecoins.

Multinationals are in the cross hairs with the implementation of protectionist policies. Within the S&P 500 Info Tech, Communication Services and Materials all have ~50% of their revenue coming from international markets. The weaker USD could be a tailwind helping to offset weakness related to any anti-American sentiment in consumer goods overseas.

Q1 shareholder return programs hit a new record driven by a big rebound in share buybacks as companies took advantage of the market weakness. Q1 repurchases jumped 20.6% to $293.5B exceeding the record set in Q1 of 2022. The largest increases were in financials, info tech, comm services and industrials. Consumer discretionary and staples both declined. As prices have recovered quickly it would not be surprising to see a pullback in activity in Q2.

Based off a recent commentary the demand for AI-capex remains robust. As we are now a couple of years into this investment cycle investors will increasingly be looking for companies to quantiy how that investment is impacting businesses. Over the coming quarters this could help to offset some of the margin pressure we discussed above.

Management teams had a steady hand during Q1 so it seems unlikely that they will begin to set off alarm bells at this point. However, outside of some select situations/industries it’s hard to see companies raising guidance given the uncertainty. The negative sentiment and price action ahead of Q1 earnings provided for a good set up for stocks.

This time around while estimates may have been sufficiently cut for companies to clear. However, the bar from a sentiment/positioning perspective is much higher with the market back at all-time highs leaving valuations stretched again with the S&P 500 trading ~24X 2025 estimates. It’s hard enough to project earnings throughout the remainder of this year but investors will soon begin to set their sights on 2026 estimates.

It is unlikely that the Q2 earnings season will shift the overarching narrative. Hopefully, there will be some more clarity by the end of the summer in the meantime. The lack of a market response as President Trump has turned up the volume on trade suggests investors are comfortably numb.