Review of Q1 2023: Growing market share

Published

As the ETF industry enters its 30th year and the active market enters its 16th year, the New York Stock Exchange made five more bold predictions for the active ETF market in 2023:

- Assets under management (AUM): Grow from $340 billion to exceed $450 billion by year end 2023

- Full-year cash flow: Make it three years in a row with over $80 billion

- Mutual fund to ETF conversions: 15+ issuers will complete mutual fund to ETF conversions totaling over $20 billion

- Active semi-transparent: 10+ ETFs will launch, and assets will exceed $7.5 billion

- Growth milestone: At least two issuers will eclipse $75 billion in AUM

So how did we do through quarter one?

- Assets have grown to over $380 billion. Give us three more quarters of comparable growth and we will have hit the mark.

- Quarter one cash flow totaled $26.5 billion. A pace that sets us on course for the full year and is ahead of last year’s quarter one total.

- The industry welcomed six active ETFs from five separate issuers via conversion in quarter one, with combined assets on conversion of $1.0 billion. A healthy start, but we will need to see assets climb.

- Five new active semi-transparent ETFs came to market in Q1 2023, and assets now stand at $6.2 billion. Despite continued investment limitations, the broader market had nearly matched the full-year 2022 total with nearly $1 billion in new cash flow in Q1 2023.

- Dimensional ended the quarter with $82.8 billion in assets. We are halfway there. JPMorgan continues to grow and now sits within striking distance with $66.4 billion.

Beyond our bold predictions, there are three additional stats from the quarter that stood out to us:

- Active ETF cash flow as a percentage of total ETF industry cash flow: 33%, a new record for a quarter

- Firms with positive cash flow: 149 firms, or nearly 70% of firms; down from 80% for full year 2022

- ETFs with positive cash flow: 534 active ETFs, or slightly over 50% of all ETFs; down from 649 for full year 2022

Quarterly Active ETF Cash Flows

Source: Factset as of 3/31/2023

Passive vs Active Quarterly Cash Flows

Source: Factset as of 3/31/2023

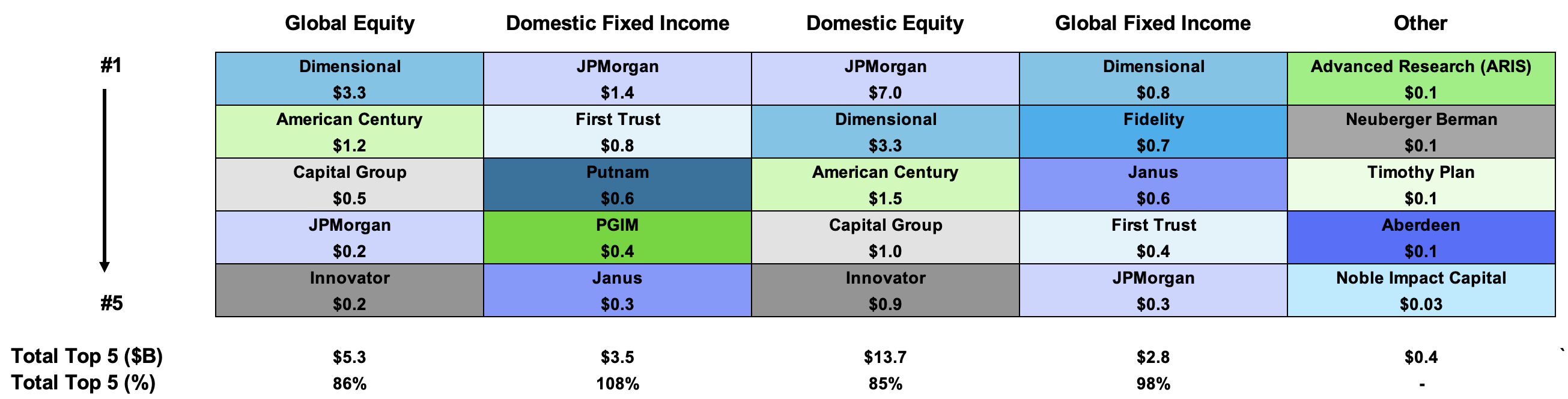

The actively managed ETF industry grew across most asset classes through Q1 2023. Equity flows continued to be the story of the industry, leading the way with $22.2 billion. Investors favored domestic equity exposure (+$16.6 billion) to global (+$6.2 billion). Notably, ETFs that focused on core building block exposures, value and offered an options overlay led the way. Fixed income flows, $6.1 billion, rallied from a slow 2022 (+$8.4 billion). Investors demonstrated renewed interest in core/intermediate-term strategies and continued interest in short-term and CLO strategies. Alternatives, $0.04 billion, lost their record 2022 flow momentum. The combination of managed futures and real return strategies that were in vogue in 2022 experienced a more muted start to the year. Commodities continued a trend from the second half of 2022 with outflows of $1.3 billion.

Active ETF Flows by Asset Class

Source: Factset as of 3/31/2023

| Global Equity | Domestic Equity | Domestic Fixed Income | Global Fixed Income | Commodities | Asset Allocation | Alternatives | Currency | |

|---|---|---|---|---|---|---|---|---|

| AUM Leader | Dimensional | Dimensional | JPMorgan | First Trust | Invesco | Cabana | Advanced Research (ARIS) | WisdomTree |

| AUM Leader $B | $24.7 | $53.1 | $30.6 | $15.9 | $5.7 | $1.2 | $1.1 | $0.4 |

| Q1 CF Leader | Dimensional | JPMorgan | JPMorgan | Dimensional | Neuberger Berman | ETF Architect | Advanced Research (ARIS) | Simplify |

| Q1 CF Leader $B | $3.3 | $7.0 | $1.4 | $0.8 | $0.1 | $0.03 | $0.1 | $0.01 |

Source: Factset as of 3/31/2023

At the issuer level, JPMorgan and Dimensional again positioned themselves to be cash flow leaders in 2023, taking in $8.7 billion and $7.4 billion, respectively. The two firms demonstrated leadership in different ways, as Dimensional had inflows into all 30 ETFs during the quarter while JPMorgan had two of the top three biggest cash flow winners of the quarter: JEPI (+$6.0 billion), JEPQ (+1.0 billion) and JPST (+$0.9 billion). American Century/Avantis (+$2.8 billion), Capital Group (+$1.8 billion), First Trust (+$1.4 billion), Putnam (+$1.3 billion) and Innovator (+$1.0 billion) rounded out the list of issuers with greater than $1 billion in cash flows for their actively managed lineups. American Century/Avantis and Capital Group both saw flows across their lineups into their broader market, lower cost actively managed ETFs. Notably, neither firm had an ETF with an outflow during the quarter. First Trust primary flows were across short duration and core fixed income along with a range of its defined outcome strategies. Putnam nearly cracked the top five for the first time with strong inflows into its equity and fixed income ESG ETFs. Innovator’s flows were largely driven by its US-focused Jan-March Power Buffer defined outcome strategies.

Q1 2023 Cash Flow Leaders by Asset Class

During Q1, over 65% of issuers experienced positive cash flows and nearly a fourth had cash flows in excess of $25 million. In addition to the seven issuers mentioned above, Janus Henderson (+$0.8 billion), Fidelity (+$0.8 billion), PGIM (+$0.5 billion), Amplify (+$0.3 billion) and AXS (+0.3 billion) all crossed $0.25 billion in net cash flows. These five issuers found varied paths to their success, from ultra-short fixed income (PGIM), dividend income (Amplify), AAA-rated CLOs (Janus Henderson), core fixed income (Fidelity) and single ETF/stock inverse (AXS).

| Ticker | Top 10 ETFs by Cash Flow ($B) | Q1 2023 ($M) |

|---|---|---|

| JEPI | JPMorgan Equity Premium Income ETF | $6,079 |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $1,185 |

| JEPQ | J.P. Morgan Nasdaq Equity Premium Income ETF | $978 |

| JPST | JPMorgan Ultra-Short Income ETF | $973 |

| AVUV | Avantis U.S. Small Cap Value ETF | $822 |

| FBND | Fidelity Total Bond ETF | $764 |

| DFIC | Dimensional International Core Equity 2 ETF | $748 |

| JAAA | Janus Detroit Street Trust Janus Henderson AAA CLO ETF | $595 |

| AVUS | Avantis U.S. Equity ETF | $558 |

| DFCF | Dimensional Core Fixed Income ETF | $558 |

Source: Factset as of 12/31/2022

| Ticker | Bottom 10 ETFs by Cash Flow ($B) | Q1 2023 ($M) |

|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $(895) |

| COMT | iShares U.S. ETF Trust iShares GSCI Commodity Dynamic Roll Strategy ETF | $(846) |

| ICSH | BlackRock Ultra Short-Term Bond ETF | $(798) |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $(416) |

| FTSL | First Trust Senior Loan Fund | $(329) |

| FTGC | First Trust Global Tactical Commodity Strategy Fund | $(286) |

| GSY | Invesco Ultra Short Duration ETF | $(223) |

| IVOL | Quadratic Interest Rate Volatility & Inflation Hedge ETF | $(206) |

| JPRE | JPMorgan Realty Income ETF | $(186) |

| PDBC | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | $(170) |

At the product level, over 50% of active ETFs saw positive flows for the quarter and 114 experienced flows over $50 million (often viewed as a general break-even measure for an ETF). The industry’s asset weighted expense ratio stayed steady at 0.44% through the quarter. Nearly 80% of all cash flows went into ETFs with expense ratios below the industry average. In spite of this, only six of the 54 ETFs launched during the quarter offered an expense ratio below the industry average.

| Expense Ratio | 3/31/23 AUM | Q1 2023 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $132,955,627,003 | $8,552,166,671 | 35% | 32% | 106 |

| 26-50 | $119,264,618,065 | $13,048,369,517 | 31% | 49% | 230 |

| 51-75 | $68,863,405,209 | $3,231,728,928 | 18% | 12% | 278 |

| 76+ | $59,829,416,208 | $1,688,146,285 | 16% | 6% | 403 |

| Expense Ratio | 3/31/22 AUM | Q1 2022 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $91,257,110,698 | $6,770,621,100 | 30% | 27% | 79 |

| 26-50 | $79,634,437,021 | $7,863,149,615 | 26% | 31% | 176 |

| 51-75 | $78,772,747,631 | $5,079,115,244 | 26% | 20% | 202 |

| 76+ | $54,535,508,871 | $5,492,425,176 | 18% | 22% | 319 |

Source: Factset as of 3/31/2023

Q1 2023 Launch Monitor

Domestic Equity

21 ETFs Launched

$1.3 B Assets Raised

Domestic Fixed Income

4 ETFs Launched

$0.7 B Assets Raised

Alternatives

4 ETFs Launched

$75 M Assets Raised

Int'l/Global Equity

14 ETFs Launched

$265 M Assets Raised

Int'l/Global Fixed Income

5 ETFs Launched

$270 M Assets Raised

Asset Allocation

5 ETFs Launched

$212 M Assets Raised

Source: FactSet as of 3/31/2023, figures include MF-ETF conversions; Other includes Asset Allocation, Commodities & Currencies

In the first quarter of 2023, 54 actively managed ETFs launched raising $2.8 billion in assets. Launches came from 34 different issuers, including six first-time issuers. ETF development continued to focus on equities with nearly 65% of new ETFs focused on the asset class. During the quarter, Putnam launched the most ETFs and also raised the most assets, totaling five and $0.8 billion, respectively.

Q1 2023 ETF Launches

| Ticker | Name | Issuer | Launch Date | Asset Class | AUM |

|---|---|---|---|---|---|

| GCAD | Gabelli Commercial Aerospace & Defense ETF | Gabelli | 01/03/2023 | Equity | $3,598,610 |

| WCEO | Hypatia Women CEO ETF | Hypatia Capital | 01/09/2023 | Equity | $2,030,400 |

| ENAV | Mohr Sector Navigator ETF | Mohr Funds | 01/11/2023 | Equity | $26,676,663 |

| ZSB | USCF Sustainable Battery Metals Strategy Fund | USCF | 01/11/2023 | Commodities | $2,335,200 |

| MEMX | Matthews Emerging Markets ex China Active ETF | Matthews Asia | 01/11/2023 | Equity | $3,966,080 |

| CLOA | BlackRock AAA CLO ETF | iShares | 01/12/2023 | Fixed Income | $30,231,240 |

| PRFD | PIMCO Preferred & Capital Securities Active ETF | PIMCO | 01/19/2023 | Fixed Income | $46,170,000 |

| PCRB | Putnam ESG Core Bond ETF | Putnam | 01/20/2023 | Fixed Income | $460,237,650 |

| PHYD | Putnam ESG High Yield ETF | Putnam | 01/20/2023 | Fixed Income | $100,984,095 |

| PULT | Putnam ESG Ultra Short ETF | Putnam | 01/20/2023 | Fixed Income | $118,889,021 |

| PPEM | Putnam PanAgora ESG Emerging Markets Equity ETF | Putnam | 01/20/2023 | Equity | $18,552,080 |

| PPIE | Putnam PanAgora ESG International Equity ETF | Putnam | 01/20/2023 | Equity | $128,582,668 |

| GDEF | Goldman Sachs Defensive Equity ETF | GSAM | 01/23/2023 | Equity | $6,548,390 |

| GJAN | FT Cboe Vest U.S. Equity Moderate Buffer ETF - January | FT Cboe Vest | 01/23/2023 | Equity | $173,330,761 |

| CLOZ | Panagram BBB-B CLO ETF | Panagram | 01/24/2023 | Fixed Income | $67,608,000 |

| TPMN | Timothy Plan Market Neutral ETF | Timothy Plan | 01/25/2023 | Alternatives | $60,535,917 |

| FTBD | Fidelity Tactical Bond ETF | Fidelity | 01/26/2023 | Fixed Income | $14,769,521 |

| MEDX | Horizon Kinetics Medical ETF | Horizon Kinetics | 01/30/2023 | Equity | $18,338,313 |

| SPAQ | Horizon Kinetics SPAC Active ETF | Horizon Kinetics | 01/30/2023 | Equity | $14,120,221 |

| FEBT | AllianzIM U.S. Large Cap Buffer10 Feb ETF | Allianz Investment Management | 02/01/2023 | Equity | $33,072,928 |

| FEBW | AllianzIM U.S. Large Cap Buffer20 Feb ETF | Allianz Investment Management | 02/01/2023 | Equity | $52,602,480 |

| CVSE | Calvert US Select Equity ETF | Morgan Stanley | 02/01/2023 | Equity | $27,439,500 |

| CVSB | Calvert Ultra-Short Investment Grade ETF | Morgan Stanley | 02/01/2023 | Fixed Income | $21,727,040 |

| LALT | First Trust Multi-Strategy Alternative ETF | First Trust | 02/01/2023 | Alternatives | $995,390 |

| RYSE | Cboe Vest 10 Year Interest Rate Hedge ETF | Cboe Vest | 02/03/2023 | Alternatives | $3,257,675 |

| SROI | Calamos Antetokounmpo Global Sustainable Equities ETF | Calamos | 02/06/2023 | Equity | $7,502,994 |

| KRUZ | Unusual Whales Subversive Republican Trading ETF | Subversive | 02/07/2023 | Equity | $4,798,300 |

| NANC | Unusual Whales Subversive Democratic Trading ETF | Subversive | 02/07/2023 | Equity | $6,206,075 |

| RSBT | Return Stacked Bonds & Managed Futures ETF | Return Stacked | 02/08/2023 | Alternatives | $10,005,270 |

| SURI | Simplify Propel Opportunities ETF | Simplify | 02/08/2023 | Asset Allocation | $57,208,660 |

| CAMX | Cambiar Aggressive Value ETF | Cambiar Funds | 02/13/2023 | Equity | $46,076,431 |

| SUPP | Engine No. 1 Transform Supply Chain ETF | Engine No. 1 | 02/15/2023 | Equity | $9,644,934 |

| NVIR | Horizon Kinetics Energy and Remediation ETF | Horizon Kinetics | 02/22/2023 | Equity | $2,383,095 |

| BEMB | iShares J.P. Morgan Broad USD Emerging Markets Bond ETF | iShares | 02/24/2023 | Fixed Income | $40,402,000 |

| LJIM | Long Cramer Tracker ETF | Tuttle Capital Management | 03/02/2023 | Equity | $987,391 |

| SJIM | Inverse Cramer Tracker ETF | Tuttle Capital Management | 03/02/2023 | Equity | $5,542,871 |

| MART | AllianzIM U.S. Large Cap Buffer10 Mar ETF | Allianz Investment Management | 03/01/2023 | Equity | $7,607,760 |

| MARW | AllianzIM U.S. Large Cap Buffer20 Mar ETF | Allianz Investment Management | 03/01/2023 | Equity | $27,793,480 |

| CAOS | Alpha Architect Tail Risk ETF | Alpha Architect | 03/06/2023 | Asset Allocation | $147,777,422 |

| JPSV | JPMorgan Active Small Cap Value ETF | JPMAM | 03/08/2023 | Equity | $10,184,550 |

| AWEG | Alger Weatherbie Enduring Growth ETF | Alger | 03/07/2023 | Equity | $3,108,625 |

| BSVO | EA Bridgeway Omni Small-Cap Value ETF | Bridgeway | 03/13/2023 | Equity | $734,704,427 |

| JCHI | JPMorgan Active China ETF | JPMAM | 03/16/2023 | Equity | $13,221,000 |

| FUSI | American Century Multisector Floating Income ETF | American Century | 03/16/2023 | Fixed Income | $20,040,960 |

| GMAR | FT Cboe Vest U.S. Equity Moderate Buffer ETF - March | FT Cboe Vest | 03/20/2023 | Domestic | $69,358,860 |

| XMAR | FT Cboe Vest U.S. Equity Enhance & Moderate Buffer ETF - March | FT Cboe Vest | 03/20/2023 | Domestic | $112,886,310 |

| BIGB | Roundhill Big Bank ETF | Roundhill | 03/21/2023 | Domestic | $4,102,944 |

| BITC | Bitwise Bitcoin Strategy Optimum Roll ETF | Bitwise | 03/21/2023 | Global | $626,775 |

| LOWV | AB US Low Volatility Equity ETF | AllianceBernstein | 03/22/2023 | Domestic | $5,555,152 |

| HIDV | AB US High Dividend ETF | AllianceBernstein | 03/22/2023 | Domestic | $6,057,505 |

| FWD | AB Disruptors ETF | AllianceBernstein | 03/22/2023 | Global | $5,120,524 |

| DYTA | SGI Dynamic Tactical ETF | Summit Global | 03/30/2023 | Global | $2,509,000 |

| HARD | Simplify Commodities Strategy No K-1 ETF | Simplify | 03/28/2023 | Global | $3,127,900 |

| SGLC | SGI U.S. Large Cap Core ETF | Summit Global | 03/31/2023 | Domestic | $2,500,000 |

| Total - 54 New ETFs | $2,803,641,057 |

Active ETF Stat Pack

| Firms | |||

|---|---|---|---|

| # of Issuers | 220 | ||

| # of New Issuers 2023 | 10 | ||

| Products | Assets | ||

| # of ETFs | 1017 | AUM ($B) | $380.91 |

| # of New Launches 2023 | 54 | 3 Yr AUM CAGR | 60% |

| Avg. ER | 0.44% | 5 Yr AUM CAGR | 51% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $26.52 | YTD ADV (Shares) | 138.760.650 |

| 3 Yr Cash Flow | $254.52 | YTD ADV ($) | $4.62 B |

| 5 Yr Cash Flow | $315.34 | YTD Avg. Spread (bps)* | 31.09 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 3/31/2023

*Simple average

Active, Semi-Transparent ETFs

| Ticker | Inception | Name | AUM | YTD Cash Flow | 30-Day Med. Spread (bps) | ADV (shares) | Structure | LMM | Expense Ratio |

|---|---|---|---|---|---|---|---|---|---|

| EQOP | 09/17/2020 | Natixis U.S. Equity Opportunities ETF | $9,109,618 | -$41,315 | 14.68 | 60 | NYSE AMS | Citadel | 0.85% |

| VNSE | 09/17/2020 | Natixis Vaughan Nelson Select ETF | $21,122,750 | $7,945,821 | 11.52 | 9,328 | NYSE AMS | Citadel | 0.80% |

| VNMC | 09/17/2020 | Natixis Vaughan Nelson Mid Cap ETF | $7,173,259 | $0 | 14.22 | 169 | NYSE AMS | Citadel | 0.85% |

| ESGA | 07/15/2020 | American Century Sustainable Equity ETF | $117,260,400 | $1,451,226 | 12.90 | 4,177 | NYSE AMS | Citadel | 0.39% |

| MID | 07/15/2020 | American Century Mid Cap Growth Impact ETF | $36,388,960 | $5,445,129 | 12.55 | 3,832 | NYSE AMS | Citadel | 0.45% |

| ESGY | 07/01/2021 | American Century Sustainable Growth ETF | $7,364,240 | $340,530 | 9.51 | 323 | NYSE AMS | Citadel | 0.39% |

| NDVG | 08/05/2021 | Nuveen Dividend Growth ETF | $7,998,688 | $250,321 | 9.22 | 339 | NYSE AMS | Citadel | 0.64% |

| NSCS | 08/05/2021 | Nuveen Small Cap Select ETF | $5,625,698 | $0 | 14.68 | 43 | NYSE AMS | Citadel | 0.85% |

| NWLG | 08/05/2021 | Nuveen Winslow Large-Cap Growth ESG ETF | $5,085,300 | $188,861 | 10.20 | 255 | NYSE AMS | Citadel | 0.64% |

| NUGO | 09/28/2021 | Nuveen Growth Opportunities ETF | $2,449,429,600 | $84,418,259 | 10.85 | 131,751 | NYSE AMS | Citadel | 0.55% |

| SAEF | 11/16/2021 | Schwab Ariel ESG ETF | $14,133,777 | $427,650 | 44.73 | 1,881 | NYSE AMS | Flow Traders | 0.59% |

| IWLG | 06/23/2022 | IQ Winslow Large Cap Growth ETF | $18,386,550 | $3,717,510 | 25.01 | 2,246 | NYSE AMS | Citadel | 0.60% |

| IWFG | 06/23/2022 | IQ Winslow Focused Large Cap Growth ETF | $6,087,207 | $0 | 25.61 | 125 | NYSE AMS | Citadel | 0.65% |

| TSME | 10/05/2022 | Thrivent Small-Mid Cap ESG ETF | $123,208,400 | $49,986,314 | 12.72 | 30,299 | NYSE AMS | RBC | 0.65% |

| JPSV | 03/08/2023 | JPMorgan Active Small Cap Value ETF | $10,357,367 | $719,850 | 9.15 | 1,958 | NYSE AMS | Citadel | 0.74% |

| SGLC | 03/31/2023 | SGI U.S. Large Cap Core ETF | $2,531,790 | $2,499,975 | 24.41 | #NAME? | NYSE AMS | GTS | 0.85% |

| FDG | 04/02/2020 | American Century Focused Dynamic Growth ETF | $138,504,097 | $133,080 | 10.72 | 7,159 | ActiveShares | Citadel | 0.45% |

| FLV | 04/02/2020 | American Century Focused Large Cap Value ETF | $225,437,226 | $7,332,880 | 10.27 | 8,859 | ActiveShares | Citadel | 0.42% |

| FBCG | 06/04/2020 | Fidelity Blue Chip Growth ETF | $494,560,500 | $26,256,031 | 34.31 | 89,476 | Fidelity Proxy | GTS | 0.59% |

| FBCV | 06/04/2020 | Fidelity Blue Chip Value ETF | $132,162,500 | -$599,434 | 31.14 | 17,028 | Fidelity Proxy | GTS | 0.59% |

| FMIL | 06/04/2020 | Fidelity New Millennium ETF | $92,430,000 | $4,490,022 | 28.68 | 12,809 | Fidelity Proxy | GTS | 0.59% |

| FGRO | 02/04/2021 | Fidelity Growth Opportunities ETF | $145,090,500 | $74,459,622 | 15.40 | 121,475 | Fidelity Proxy | Citadel | 0.59% |

| FMAG | 02/04/2021 | Fidelity Magellan ETF | $43,500,000 | -$945,920 | 12.19 | 6,372 | Fidelity Proxy | RBC | 0.59% |

| FPRO | 02/04/2021 | Fidelity Real Estate Investment ETF | $15,933,380 | -$1,025,699 | 14.81 | 3,295 | Fidelity Proxy | Citadel | 0.59% |

| FSMO | 02/04/2021 | Fidelity Small/Mid-Cap Opportunities ETF | $30,886,500 | $2,218,239 | 8.97 | 6,031 | Fidelity Proxy | RBC | 0.59% |

| FSST | 06/17/2021 | Fidelity Sustainability U.S. Equity ETF | $8,806,680 | $952,512 | 13.70 | 1,420 | Fidelity Proxy | RBC | 0.59% |

| FDWM | 06/17/2021 | Fidelity Women's Leadership ETF | $4,948,928 | $2,106,613 | 13.82 | 314 | Fidelity Proxy | RBC | 0.59% |

| TCHP | 08/05/2020 | T. Rowe Price Blue Chip Growth ETF | $330,324,500 | $27,717,787 | 9.68 | 105,165 | T Rowe Proxy | Virtu | 0.57% |

| TDVG | 08/05/2020 | T. Rowe Price Dividend Growth ETF | $305,639,054 | $32,038,535 | 8.58 | 44,773 | T Rowe Proxy | RBC | 0.50% |

| TEQI | 08/05/2020 | T. Rowe Price Equity Income ETF | $103,708,498 | $8,071,148 | 9.65 | 14,827 | T Rowe Proxy | Virtu | 0.54% |

| TGRW | 08/05/2020 | T. Rowe Price Growth Stock ETF | $42,096,950 | $1,238,930 | 10.86 | 6,826 | T Rowe Proxy | RBC | 0.52% |

| TSPA | 06/08/2021 | T. Rowe Price U.S. Equity Research ETF | $24,925,152 | $1,826 | 10.65 | 2,431 | T Rowe Proxy | RBC | 0.52% |

| IVDG | 12/22/2020 | Invesco Focused Discovery Growth ETF | $603,006 | -$102,860 | 10.63 | 342 | Invesco Model | Citadel | 0.59% |

| IVSG | 12/22/2020 | Invesco Select Growth ETF | $915,300 | -$10,160 | 10.16 | 1,255 | Invesco Model | Citadel | 0.48% |

| IVLC | 12/22/2020 | Invesco US Large Cap Core ESG ETF | $5,865,600 | -$360 | 16.07 | 656 | Fidelity Proxy | Citadel | 0.48% |

| IVRA | 12/22/2020 | Invesco Real Assets ESG ETF | $3,120,217 | $0 | 41.07 | 988 | Fidelity Proxy | Citadel | 0.59% |

| LOPP | 02/01/2021 | Gabelli Love Our Planet & People ETF | $12,736,791 | $0 | 39.54 | 349 | ActiveShares | GTS | 0.90% |

| GGRW | 02/16/2021 | Gabelli Growth Innovators ETF | $2,382,422 | $0 | 42.05 | 101 | ActiveShares | GTS | 0.90% |

| GAST | 01/05/2022 | Gabelli Asset ETF | $4,638,648 | $0 | 45.44 | 23 | ActiveShares | GTS | 0.90% |

| GABF | 05/11/2022 | Gabelli Financial Services Opportunities ETF | $5,752,777 | $144,465 | 64.13 | 166 | ActiveShares | GTS | 0.00% |

| GCAD | 01/03/2023 | Gabelli Commercial Aerospace & Defense ETF | $3,628,466 | $1,142,855 | 38.61 | 1,057 | ActiveShares | GTS | 0.90% |

| FRTY | 03/01/2021 | Alger Mid Cap 40 ETF | $28,939,138 | -$974,000 | 55.19 | 9,894 | ActiveShares | Virtu | 0.60% |

| ATFV | 05/04/2021 | Alger 35 ETF | $9,711,225 | -$181,000 | 65.85 | 262 | ActiveShares | Virtu | 0.55% |

| AWEG | 03/07/2023 | Alger Weatherbie Enduring Growth ETF | $3,184,123 | $2,108,625 | 72.18 | 9,280 | ActiveShares | Virtu | 0.65% |

| REIT | 02/26/2021 | ALPS Active REIT ETF | $18,148,249 | $744,050 | 30.44 | 3,208 | Blue Tractor | GTS | 0.68% |

| STNC | 03/16/2021 | Hennessy Stance ESG Large Cap ETF | $44,743,595 | $539,264 | 13.02 | 2,079 | Blue Tractor | GTS | 0.85% |

| DYTA | 03/30/2023 | SGI Dynamic Tactical ETF | #NAME? | $0 | 27.96 | #NAME? | Blue Tractor | GTS | 0.95% |

| PFUT | 05/26/2021 | Putnam Sustainable Future ETF | $161,080,978 | $151,979,163 | 32.59 | 9,025 | Fidelity Proxy | Virtu | 0.64% |

| PLDR | 05/26/2021 | Putnam Sustainable Leaders ETF | $346,170,848 | $340,009,879 | 10.97 | 257,085 | Fidelity Proxy | RBC | 0.59% |

| PGRO | 05/26/2021 | Putnam Focused Large Cap Growth ETF | $26,940,540 | $15,095,596 | 11.21 | 14,220 | Fidelity Proxy | RBC | 0.55% |

| PVAL | 05/26/2021 | Putnam Focused Large Cap Value ETF | $148,602,947 | $10,599,711 | 29.68 | 22,965 | Fidelity Proxy | Virtu | 0.55% |

| HFGO | 11/09/2021 | Hartford Large Cap Growth ETF | $84,011,113 | $0 | 30.22 | 1,328 | Fidelity Proxy | Citadel | 0.59% |

| SEMI | 03/30/2022 | Columbia Seligman Semiconductor and Technology ETF | $18,220,759 | $1,342,000 | 36.18 | 2,948 | Fidelity Proxy | Virtu | 0.75% |

| CAPE | 04/05/2022 | DoubleLine Shiller CAPE U.S. Equities ETF | $244,875,939 | $21,181,200 | 17.28 | 53,380 | ActiveShares | Citadel | 0.65% |

| FMCX | 04/25/2022 | FMC Excelsior Focus Equity ETF | $73,443,668 | -$69,300 | 17.88 | 235 | ActiveShares | GTS | 0.70% |

| BYRE | 05/19/2022 | Principal Real Estate Active Opportunities ETF | $5,063,389 | $0 | 25.30 | 347 | Fidelity Proxy | Virtu | 0.65% |

| Total/Average | $6,235,506,803 | $885,345,431 | 23.02 | 1,026,239 | 0.63% |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 3/31/2023

*Simple average

Get NYSE's Active ETF Updates

NYSE Active ETF Issuer Insights

Missed our Active ETF Webinar series or latest podcast series? Visit the redesigned HomeofETFs.com to catch up.

Hear from ETF experts including active ETF structure providers, fund sponsors (American Century, Alger, Fidelity, PIMCO and T. Rowe Price), liquidity providers (Flow Traders and Jane Street), and service providers (BBH, BNY Mellon and State Street).