Review of the first half: Up & to the right

Published

As the ETF industry enters its 30th year and the active market enters its 16th year, the New York Stock Exchange made five more bold predictions for the active ETF market in 2023:

- Assets under management (AUM): Grow from $340 billion to exceed $450 billion by year end 2023

- Full-year cash flow: Make it three years in a row with over $80 billion

- Mutual fund to ETF conversions: 15+ issuers will complete mutual fund to ETF conversions totaling over $20 billion

- Active semi-transparent: 10+ ETFs will launch, and assets will exceed $7.5 billion

- Growth milestone: At least two issuers will eclipse $75 billion in AUM

So how did we do through the first half of the year?

- Assets have grown to nearly $415 billion. At this pace the industry could eclipse the half trillion market by year end.

- First half cash flow totaled $48.7 billion. Flows came down slightly quarter over quarter (Q1: $24.8 B vs. Q2: $23.8 B) yet remain on track to make our three-peat a reality.

- The industry welcomed sixteen active ETFs from ten separate issuers via conversion in the first half, with combined assets on conversion of $3.0 billion. A healthy start, but we will need to see assets climb.

- Seven new active semi-transparent ETFs came to market in the first half, and assets now stand at nearly $7.0 billion. Despite continued investment limitations, the broader market had nearly matched the full year 2022 total with nearly $1 billion in new cash flow.

- Dimensional ended the first half with $93.6 billion in assets. We are halfway there. JPMorgan continues to grow and now sits within striking distance with $70.4 billion.

Beyond our bold predictions, there are three additional stats from the first half that stood out to us:

- Active ETF cash flow as a percentage of total ETF industry cash flow: 25%, a new record for a half year period and well exceeding the market’s ~5% asset market share

- Firms with postive cash flow: 159 firms, or nearly 70% of firms; down from 80% for full year 2022 and unchanged from the prior quarter

- ETFs with postive cash flow: 635 active ETFs, or nearly 60% of all ETFs; up from 534 for quarter one 2023

Quarterly Active ETF Cash Flows

Source: Factset as of 6/30/2023

Passive vs Active Quarterly Cash Flows

Source: Factset as of 6/30/2023

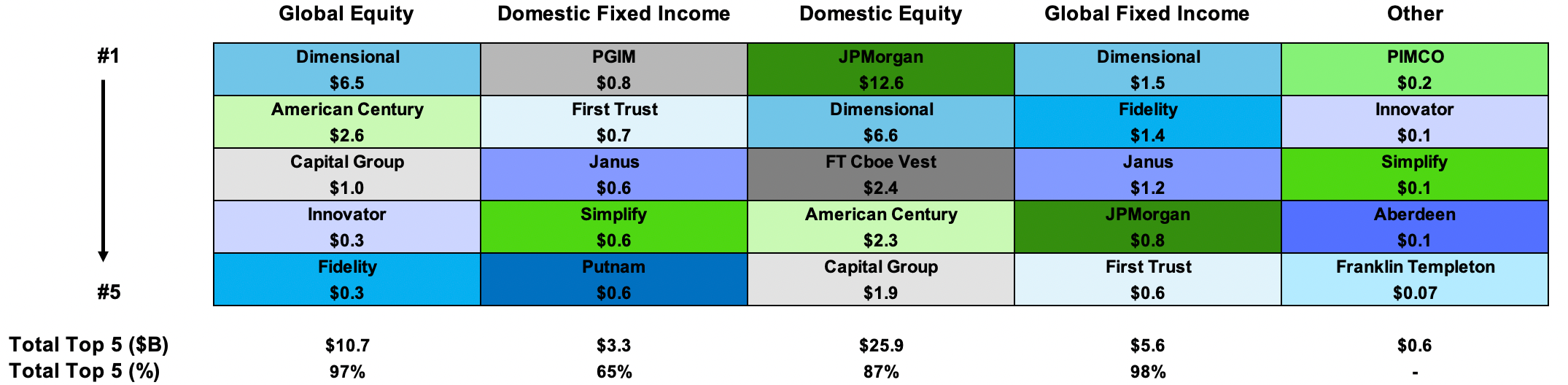

The actively managed ETF industry saw mixed growth across asset classes through the first half of the year. Equity flows continued to be the story of the industry, leading the way with $41.0 billion. Investors favored domestic equity exposure (+$29.9 billion) to global (+$11.1 billion). Notably, ETFs that focused on core building block exposures, value and offered an options overlay led the way. Fixed income flows, $10.7 billion, were balanced across domestic (+$5.0 billion) vs. global exposures ($5.7 billion). Investors demonstrated continued interest in core/intermediate term strategies, short term/cash alternatives and CLO strategies. Alternatives, commodities, currencies and asset allocation strategies all saw outflows through the first half. The outflows were led by commodities (-$2.1 billion) which continued a trend that started in the second half of 2022. Notably, under 50% of ETFs in these asset classes saw positive inflows.

Active ETF Flows by Asset Class

Source: Factset as of 6/30/2023

| Global Equity | Domestic Equity | Domestic Fixed Income | Global Fixed Income | Commodities | Asset Allocation | Alternatives | Currency | |

|---|---|---|---|---|---|---|---|---|

| AUM Leader | Dimensional | Dimensional | JPMorgan | First Trust | Invesco | Wisdom Tree | First Trust | WisdomTree |

| AUM Leader $B | $28.3 | $59.5 | $27.5 | $16.1 | $4.8 | $1.2 | $1.1 | $0.2 |

| Q2 CF Leader | Dimensional | JPMorgan | JPMorgan | Dimensional | PIMCO | Innovator | Advanced Research (ARIS) | Simplify |

| Q2 CF Leader $B | $6.5 | $12.6 | $0.8 | $1.5 | $0.2 | $0.1 | $0.1 | $0.01 |

Source: Factset as of 6/30/2023

At the issuer level, Dimensional (+$14.9 billion) and JPMorgan (+$13.6 billion) continued their back and forth for the cash flow crown. Dimensional took the first half crown on the back of a stronger Q2 than JPM. The two firms again demonstrated leadership in different ways, as Dimensional maintained the impressive streak of positive cash flow into all 31 ETFs during the first half while JPMorgan had the two biggest cash flow winners of the first half: JEPI (+$10.1 billion) & JEPQ (+$2.5 billion). American Century/Avantis (+$5.2 billion), Capital Group (+$3.6 billion) and First Trust/Cboe Vest (+$3.0 billion) rounded out the top five. American Century/Avantis and Capital Group both saw flows across their lineups into their broader market, lower cost actively managed ETFs. Notably, between the two firms they only had one ETF with an outflow during the first half. First Trust’s primary flows were across short duration and core fixed income along with a range of its defined outcome strategies with Cboe Vest. Janus (+$1.8 billion), Fidelity (+$1.7 billion), Innovator (+$1.7 billion) and Putnam (+$1.4 billion) rounded out the list of issuers with greater than $1 billion in cash flows for their actively managed lineups. Janus was carried by continued flows in its CLO ETF (JAAA, +$1.3 billion) and new inflows into its mortgage-backed security ETF (JMBS, +$0.6 billion). Fidelity’s flows were driven by its Total Bond ETF (FBND, $1.5 billion).

Q2 2023 Cash Flow Leaders by Asset Class

Source: Factset as of 6/30/2023

Through the first half of the year, nearly 70% of issuers experienced positive cash flows and over 30 firms had cash flows in excess of $100 million. In addition to the issuers mentioned above, PGIM (+$0.9 billion), PIMCO ($0.5 billion), Simplify ($0.5 billion), AB ($0.4 billion), Amplify ($0.4 billion), Direxion ($0.4 billion), Allianz (+$0.35 billion), Envestnet ($0.35 billion), AXS ($0.35 billion), ETF Architect ($0.3 billion) and Franklin Templeton ($0.3 billion) all eclipsed $250 million in flows. PGIM, PIMCO and AB were all led by investor interest in their short-term fixed income strategies. Simplify benefited from interest in its short treasury futures strategy ETF (TUA, +$0.7 billion) and volatility premium ETF (SVOL, $0.2 billion). Amplify was led by its dividend income ETF (DIVO, $0.4 billion). Direxion and AXS were led by single stock levered/inverse ETFs tied to TSLA and NVDA. Allianz continued to gain momentum with its growing suite (21 ETFs) of defined outcome strategies. New entrant Envestnet saw inflows across its suite of novel ActivePassive ETFs. ETF Architect and Franklin Templeton were respectively led by flows into cash alternative and core bond exposure ETFs.

| Ticker | Top 10 ETFs by Cash Flow ($B) | Q2 2023 ($M) |

|---|---|---|

| JEPI | JPMorgan Equity Premium Income ETF | $10,125 |

| JEPQ | J.P. Morgan Nasdaq Equity Premium Income ETF | $2,532 |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $2,434 |

| FBND | Fidelity Total Bond ETF | $1,522 |

| DFIC | Dimensional International Core Equity 2 ETF | $1,432 |

| JAAA | Janus Detroit Street Trust Janus Henderson AAA CLO ETF | $1,283 |

| FIXD | First Trust TCW Opportunistic Fixed Income ETF | $1,269 |

| AVUV | Avantis U.S. Small Cap Value ETF | $1,195 |

| DFCF | Dimensional Core Fixed Income ETF | $1,055 |

| DUHP | Dimensional US High Profitability ETF | $980 |

Source: Factset as of 12/31/2022

| Ticker | Bottom 10 ETFs by Cash Flow ($B) | Q1 2023 ($M) |

|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $(1,510) |

| ICSH | BlackRock Ultra Short-Term Bond ETF | $(1,007) |

| COMT | iShares U.S. ETF Trust iShares GSCI Commodity Dynamic Roll Strategy ETF | $(930) |

| PDBC | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | $(790) |

| FTGC | First Trust Global Tactical Commodity Strategy Fund | $(580) |

| FTSL | First Trust Senior Loan Fund | $(579) |

| ARKK | ARK Innovation ETF | $(537) |

| NEAR | BlackRock Short Maturity Bond ETF | $(391) |

| JCPI | JP Morgan Inflation Managed Bond ETF | $(340) |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $(335) |

At the product level, nearly 60% of active ETFs saw positive flows during the first half and 175 experienced flows over $50 million (often viewed as a general break-even measure for an ETF). The industry’s asset weighted expense ratio ticked down a basis point to 0.43%. Nearly 90% of all cash flows went into ETFs with expense ratios below the industry average. In spite of this, only 26 of the 135 ETFs launched during the quarter offered an expense ratio below the industry average.

| Expense Ratio | 3/31/23 AUM | Q1 2023 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $144,259,230,222 | $15,508,146,971 | 35% | 32% | 107 |

| 26-50 | $137,100,827,819 | $26,843,128,522 | 33% | 55% | 249 |

| 51-75 | $69,075,509,056 | $2,980,922,543 | 17% | 6% | 299 |

| 76+ | $62,644,134,602 | $3,362,459,336 | 15% | 7% | 411 |

| Expense Ratio | 3/31/22 AUM | Q1 2022 CF | % AUM | % CF | # ETFs |

|---|---|---|---|---|---|

| 0-25 | $102,974,215,291 | $15,449,969,530 | 34% | 35% | 87 |

| 26-50 | $83,452,066,537 | $14,918,852,834 | 27% | 34% | 182 |

| 51-75 | $65,126,634,218 | $4,993,874,848 | 21% | 11% | 215 |

| 76+ | $51,927,616,952 | $9,151,074,581 | 17% | 21% | 315 |

Source: Factset as of 6/30/2023

As the industry enters the second half, we will be keeping a watchful eye on the record setting pace of active ETF adoption and how our five bold predictions for 2023 are playing out.

First Half Launch Monitor

Domestic Equity

54 ETFs Launched

$3.2 B Assets Raised

Domestic Fixed Income

10 ETFs Launched

$1.0 B Assets Raised

Alternatives

8 ETFs Launched

$90 M Assets Raised

Int'l/Global Equity

35 ETFs Launched

$1.5 B Assets Raised

Int'l/Global Fixed Income

12 ETFs Launched

$630 M Assets Raised

Other

16 ETFs Launched

$745 M Assets Raised

Source: FactSet as of 6/30/2023, figures include MF-ETF conversions; Other includes Asset Allocation, Commodities & Currencies

In the first half of 2023, 135 actively managed ETFs launched raising $7.1 billion in assets. Launches came from 66 different issuers, including 24 first-time issuers. ETF development continued to focus on equities with over 65% of new ETFs focused on the asset class. Allianz and FT/Cboe Vest each launched eight ETFs during the first half, followed by Fidelity with seven. FT/Cboe Vest raised the most assets into its new ETFs with $1.2 billion followed by Putnam with $0.8 billion.

Q2 2023 ETF Launches

| Ticker | Name | Issuer | Launch Date | Asset Class | AUM |

|---|---|---|---|---|---|

| APRD | Innovator Premium Income 10 Barrier ETF - April | Innovator | 4/3/23 | Asset Allocation | $9,928,000 |

| APRH | Innovator Premium Income 20 Barrier ETF - April | Innovator | 4/3/23 | Asset Allocation | $27,203,000 |

| APRJ | Innovator Premium Income 30 Barrier ETF - April | Innovator | 4/3/23 | Asset Allocation | $51,107,250 |

| APRQ | Innovator Premium Income 40 Barrier ETF - April | Innovator | 4/3/23 | Asset Allocation | $36,181,750 |

| DMBS | DoubleLine Mortgage ETF | DoubleLine | 4/4/23 | Fixed Income | $99,363,849 |

| DCMB | DoubleLine Commercial Real Estate ETF | DoubleLine | 4/4/23 | Fixed Income | $27,167,450 |

| BIGT | Roundhill BIG Tech ETF | Roundhill | 4/11/23 | Equity | $3,570,000 |

| LZRD | Parabla Innovation ETF | Parabla | 4/11/23 | Equity | $764,135 |

| MKAM | MKAM ETF | MKAM | 4/12/23 | Asset Allocation | $4,132,800 |

| BTR | Beacon Tactical Risk ETF | Beacon Capital Management | 4/18/23 | Asset Allocation | $16,361,400 |

| BSR | Beacon Selective Risk ETF | Beacon Capital Management | 4/18/23 | Asset Allocation | $18,367,700 |

| APLY | YieldMax AAPL Option Income Strategy ETF | YieldMax | 4/18/23 | Equity | $10,752,290 |

| ZIVB | -1x Short VIX Mid-Term Futures Strategy ETF | Volatility Shares | 4/19/23 | Alternatives | $931,905 |

| FDAT | Tactical Advantage ETF | Family Dynasty Advisors | 4/20/23 | Asset Allocation | $9,517,500 |

| GAPR | FT Cboe Vest U.S. Equity Moderate Buffer ETF - April | FT Cboe Vest | 4/24/23 | Equity | $206,424,437 |

| MDLV | Morgan Dempsey Large Cap Value ETF | Morgan Dempsey | 4/26/23 | Equity | $28,660,302 |

| DOGG | FT Cboe Vest DJIA Dogs 10 Target Income ETF | FT Cboe Vest | 4/27/23 | Equity | $3,946,639 |

| QWST | Harbor Small Cap Explorer ETF | Harbor | 4/27/23 | Equity | $10,478,000 |

| MAYT | AllianzIM U.S. Large Cap Buffer10 May ETF | Allianz Investment Management | 5/1/23 | Equity | $40,441,670 |

| MAYW | AllianzIM U.S. Large Cap Buffer20 May ETF | Allianz Investment Management | 5/1/23 | Equity | $90,079,850 |

| HEAT | Touchstone Climate Transition ETF | Touchstone Investments | 5/2/23 | Equity | $11,788,200 |

| APCB | ActivePassive Core Bond ETF | Envestnet | 5/3/23 | Fixed Income | $94,364,800 |

| APMU | ActivePassive Intermediate Municipal Bond ETF | Envestnet | 5/3/23 | Fixed Income | $29,594,040 |

| APIE | ActivePassive International Equity ETF | Envestnet | 5/3/23 | Equity | $71,628,480 |

| APUE | ActivePassive U.S. Equity ETF | Envestnet | 5/3/23 | Equity | $169,171,620 |

| USE | USCF Energy Commodity Strategy Absolute Return Fund | USCF | 5/4/23 | Alternatives | $3,077,400 |

| CLIA | Veridien Climate Action ETF | Veridien | 5/9/23 | Equity | $2,698,450 |

| IQRA | IQ CBRE Real Assets ETF | IndexIQ | 5/10/23 | Equity | $4,834,000 |

| CMDT | PIMCO Commodity Strategy Active Exchange-Traded Fund | PIMCO | 5/10/23 | Commodities | $195,851,250 |

| TOLL | Tema Monopolies and Oligopolies ETF | Tema | 5/11/23 | Equity | $6,193,992 |

| BDGS | Bridges Capital Tactical ETF | Bridges | 5/11/23 | Equity | $14,314,328 |

| NVDY | YieldMax NVDA Option Income Strategy ETF | YieldMax | 5/11/23 | Equity | $16,466,635 |

| RSHO | Tema American Reshoring ETF | Tema | 5/11/23 | Equity | $7,753,671 |

| LUX | Tema Luxury ETF | Tema | 5/11/23 | Equity | $7,448,310 |

| BKIV | BNY Mellon Innovators ETF | BNY Mellon | 5/17/23 | Equity | $10,916,027 |

| BKWO | BNY Mellon Women's Opportunities ETF | BNY Mellon | 5/17/23 | Equity | $10,453,226 |

| ZTAX | X-Square Municipal Income Tax Free ETF | X-Square | 5/19/23 | Fixed Income | $2,013,457 |

| PEMX | Putnam Emerging Markets ex-China ETF | Putnam | 5/18/23 | Equity | $6,342,893 |

| ECML | Euclidean Fundamental Value ETF | Euclidean | 5/18/23 | Equity | $147,906,990 |

| CHAT | Roundhill Generative AI & Technology ETF | Roundhill | 5/18/23 | Equity | $80,959,095 |

| HYFI | AB High Yield ETF | AllianceBernstein | 5/15/23 | Fixed Income | $67,211,882 |

| EMM | Global X Emerging Markets ETF | Global X | 5/15/23 | Equity | $26,882,198 |

| EMC | Global X Emerging Markets Great Consumer ETF | Global X | 5/15/23 | Equity | $351,954,681 |

| GMAY | FT Cboe Vest U.S. Equity Moderate Buffer ETF - May | FT Cboe Vest | 5/22/23 | Equity | $125,161,462 |

| SMAY | FT Cboe Vest U.S. Small Cap Moderate Buffer ETF - May | FT Cboe Vest | 5/22/23 | Equity | $19,722,042 |

| BLCV | BlackRock Large Cap Value ETF | iShares | 5/23/23 | Equity | $6,255,528 |

| BINC | BlackRock Flexible Income ETF | iShares | 5/23/23 | Fixed Income | $88,268,600 |

| AIDB | QRAFT AI-Pilot U.S. Large Cap Dynamic Beta and Income ETF | ETC | 5/24/23 | Equity | $3,144,026 |

| JUNT | AllianzIM U.S. Large Cap Buffer10 Jun ETF | Allianz Investment Management | 6/1/23 | Equity | $25,957,300 |

| JUNW | AllianzIM U.S. Large Cap Buffer20 Jun ETF | Allianz Investment Management | 6/1/23 | Equity | $67,919,765 |

| INCM | Franklin Income Focus ETF | Franklin Templeton | 6/8/23 | Asset Allocation | $100,360,000 |

| RUNN | Running Oak Efficient Growth ETF | Running Oak | 6/8/23 | Equity | $17,899,132 |

| RMIF | LHA Risk-Managed Income ETF | Little Harbor Advisors | 6/9/23 | Fixed Income | $32,049,803 |

| FBOT | Fidelity Disruptive Automation ETF | Fidelity | 6/12/23 | Equity | $117,401,263 |

| FDCF | Fidelity Disruptive Communications ETF | Fidelity | 6/12/23 | Equity | $38,422,484 |

| FDFF | Fidelity Disruptive Finance ETF | Fidelity | 6/12/23 | Equity | $41,786,553 |

| FMED | Fidelity Disruptive Medicine ETF | Fidelity | 6/12/23 | Equity | $43,056,644 |

| FDTX | Fidelity Disruptive Technology ETF | Fidelity | 6/12/23 | Equity | $101,618,476 |

| PRVT | Private Real Estate Strategy via Liquid REITs ETF | Armada ETF Advisors | 6/13/23 | Equity | $505,500 |

| EVXX | Defiance Pure Electric Vehicle ETF | Defiance ETFs | 6/13/23 | Equity | $661,500 |

| EQLS | Simplify Market Neutral Equity Long/Short ETF | Simplify | 6/14/23 | Alternatives | $4,310,275 |

| DUBS | Aptus Large Cap Enhanced Yield ETF | Aptus | 6/14/23 | Equity | $2,517,000 |

| TVAL | T. Rowe Price Value ETF | T. Rowe Price | 6/15/23 | Equity | $13,876,979 |

| TMSL | T. Rowe Price Small-Mid Cap ETF | T. Rowe Price | 6/15/23 | Equity | $16,503,491 |

| TCAF | T. Rowe Price Capital Appreciation Equity ETF | T. Rowe Price | 6/15/23 | Equity | $50,378,054 |

| GJUN | FT Cboe Vest U.S. Equity Moderate Buffer ETF - June | FT Cboe Vest | 6/20/23 | Equity | $224,741,710 |

| FDIF | Fidelity Disruptors ETF | Fidelity | 6/20/23 | Equity | $94,123,660 |

| FFLS | Future Fund Long/Short ETF | The Future Fund, LLC | 6/21/23 | Alternatives | $1,560,800 |

| PYLD | PIMCO Multisector Bond Active Exchange-Traded Fund | PIMCO | 6/22/23 | Fixed Income | $62,773,200 |

| BILZ | PIMCO Ultra Short Government Active Exchange-Traded Fund | PIMCO | 6/22/23 | Fixed Income | $13,014,300 |

| HCMT | Direxion HCM Tactical Enhanced US ETF | Direxion Shares | 6/22/23 | Equity | $149,754,400 |

| CRDT | Simplify Opportunistic Income ETF | Simplify | 6/27/23 | Fixed Income | $37,503,025 |

| DFCA | Dimensional California Municipal Bond ETF | Dimensional Fund Advisors | 6/27/23 | Fixed Income | $34,983,760 |

| AVNV | Avantis All International Markets Value ETF | American Century | 6/29/23 | Equity | $125,847 |

| AVNM | Avantis All International Markets Equity ETF | American Century | 6/29/23 | Equity | $125,825 |

| AVMA | Avantis Moderate Allocation ETF | American Century | 6/29/23 | Asset Allocation | $126,333 |

| AVGV | Avantis All Equity Markets Value ETF | American Century | 6/29/23 | Equity | $1,019,160 |

| LSGR | Natixis Loomis Sayles Focused Growth ETF | Natixis | 6/29/23 | Equity | $5,249,370 |

| IVVB | iShares Large Cap Deep Buffer ETF | iShares | 6/30/23 | Equity | $10,011,863 |

| IVVM | iShares Large Cap Moderate Buffer ETF | iShares | 6/30/23 | Equity | $10,011,863 |

| BDVG | IMGP Berkshire Dividend Growth ETF | Litman Gregory | 6/30/23 | Equity | $765,480 |

| Total - 81 New ETFs | Total | $3,598,872,023 |

Active ETF Stat Pack

| Firms | |||

|---|---|---|---|

| # of Issuers | 228 | ||

| # of New Issuers 2023 | 24 | ||

| Products | Assets | ||

| # of ETFs | 1066 | AUM ($B) | $413.08 |

| # of New Launches 2023 | 135 | 3 Yr AUM CAGR | 52% |

| Avg. ER | 0.43% | 5 Yr AUM CAGR | 49% |

| Cash Flow | Trading | ||

| YTD Cash Flow ($B) | $26.52 | YTD ADV (Shares) | 128,960,281 |

| 3 Yr Cash Flow | $254.52 | YTD ADV ($) | $4.21 B |

| 5 Yr Cash Flow | $315.34 | YTD Avg. Spread (bps)* | 30.33 |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 6/30/2023

*Simple average

Active, Semi-Transparent ETFs

| Ticker | Inception | Name | AUM | YTD Flows | 30 Day Median Spread (bps) | ADV (shares) | Structure | LMM | Expense Ratio |

|---|---|---|---|---|---|---|---|---|---|

| EQOP | 9/17/20 | Natixis U.S. Equity Opportunities ETF | $9,936,364 | -$61,710 | 15.24 | 59 | NYSE AMS | Citadel | 0.85% |

| VNSE | 9/17/20 | Natixis Vaughan Nelson Select ETF | $30,900,628 | $16,328,460 | 13.75 | 7,408 | NYSE AMS | Citadel | 0.80% |

| VNMC | 9/17/20 | Natixis Vaughan Nelson Mid Cap ETF | $7,696,955 | $289,302 | 13.89 | 138 | NYSE AMS | Citadel | 0.85% |

| ESGA | 7/15/20 | American Century Sustainable Equity ETF | $137,902,963 | $14,640,851 | 13.58 | 5,908 | NYSE AMS | Citadel | 0.39% |

| MID.ETF | 7/15/20 | American Century Mid Cap Growth Impact ETF | $42,204,313 | $10,170,195 | 13.66 | 3,483 | NYSE AMS | Citadel | 0.45% |

| ESGY | 7/1/21 | American Century Sustainable Growth ETF | $10,575,656 | $2,741,306 | 10.06 | 1,047 | NYSE AMS | Citadel | 0.39% |

| NDVG | 8/5/21 | Nuveen Dividend Growth ETF | $8,324,224 | $250,321 | 8.45 | 264 | NYSE AMS | Citadel | 0.64% |

| NSCS | 8/5/21 | Nuveen Small Cap Select ETF | $5,822,362 | $0 | 11.83 | 81 | NYSE AMS | Citadel | 0.85% |

| NWLG | 8/5/21 | Nuveen Winslow Large-Cap Growth ESG ETF | $5,613,725 | $188,861 | 9.60 | 147 | NYSE AMS | Citadel | 0.64% |

| NUGO | 9/28/21 | Nuveen Growth Opportunities ETF | $2,681,024,103 | $69,590 | 8.95 | 161,992 | NYSE AMS | Citadel | 0.55% |

| SAEF | 11/16/21 | Schwab Ariel ESG ETF | $15,912,000 | $1,595,000 | 42.28 | 2,302 | NYSE AMS | Flow Traders | 0.59% |

| IWLG | 6/23/22 | IQ Winslow Large Cap Growth ETF | $20,491,900 | $3,717,510 | 22.24 | 1,129 | NYSE AMS | Citadel | 0.60% |

| IWFG | 6/23/22 | IQ Winslow Focused Large Cap Growth ETF | $6,699,630 | $0 | 22.28 | 131 | NYSE AMS | Citadel | 0.65% |

| TSME | 10/5/22 | Thrivent Small-Mid Cap ESG ETF | $137,529,120 | $59,207,788 | 9.86 | 19,029 | NYSE AMS | RBC | 0.65% |

| JPSV | 3/8/23 | JPMorgan Active Small Cap Value ETF | $10,839,400 | $957,350 | 8.74 | 756 | NYSE AMS | Citadel | 0.74% |

| LSGR | 6/29/23 | Natixis Loomis Sayles Focused Growth ETF | $5,249,370 | $5,249,975 | 16.17 | 100,329 | NYSE AMS | Citadel | 0.59% |

| SGLC | 3/31/23 | SGI U.S. Large Cap Core ETF | $68,225,500 | $65,052,925 | 19.07 | 43,906 | NYSE AMS | GTS | 0.85% |

| FDG | 4/2/20 | American Century Focused Dynamic Growth ETF | $173,706,344 | $19,967,676 | 10.11 | 11,365 | ActiveShares | Citadel | 0.45% |

| FLV | 4/2/20 | American Century Focused Large Cap Value ETF | $233,779,960 | $11,054,828 | 10.65 | 8,252 | ActiveShares | Citadel | 0.42% |

| FBCG | 6/4/20 | Fidelity Blue Chip Growth ETF | $640,838,634 | $97,084,803 | 25.01 | 117,675 | Fidelity Proxy | GTS | 0.59% |

| FBCV | 6/4/20 | Fidelity Blue Chip Value ETF | $124,344,144 | -$10,215,083 | 27.85 | 17,692 | Fidelity Proxy | GTS | 0.59% |

| FMIL | 6/4/20 | Fidelity New Millennium ETF | $96,697,215 | $2,504,630 | 22.90 | 12,813 | Fidelity Proxy | GTS | 0.59% |

| FGRO | 2/4/21 | Fidelity Growth Opportunities ETF | $174,186,929 | $84,964,231 | 15.50 | 77,632 | Fidelity Proxy | Citadel | 0.59% |

| FMAG | 2/4/21 | Fidelity Magellan ETF | $47,992,433 | $40,271 | 11.40 | 8,330 | Fidelity Proxy | RBC | 0.59% |

| FPRO | 2/4/21 | Fidelity Real Estate Investment ETF | $14,860,289 | -$2,050,746 | 13.00 | 3,243 | Fidelity Proxy | Citadel | 0.59% |

| FSMO | 2/4/21 | Fidelity Small/Mid-Cap Opportunities ETF | $32,861,380 | $3,277,425 | 8.64 | 5,731 | Fidelity Proxy | RBC | 0.60% |

| FSST | 6/17/21 | Fidelity Sustainability U.S. Equity ETF | $9,865,170 | $1,469,956 | 11.49 | 1,428 | Fidelity Proxy | RBC | 0.59% |

| FDWM | 6/17/21 | Fidelity Women's Leadership ETF | $3,285,721 | $346,522 | 12.70 | 1,308 | Fidelity Proxy | RBC | 0.59% |

| TCHP | 8/5/20 | T. Rowe Price Blue Chip Growth ETF | $350,713,262 | $2,846,761 | 9.32 | 94,795 | T Rowe Proxy | Virtu | 0.57% |

| TDVG | 8/5/20 | T. Rowe Price Dividend Growth ETF | $304,174,142 | $21,612,438 | 7.47 | 56,525 | T Rowe Proxy | RBC | 0.50% |

| TEQI | 8/5/20 | T. Rowe Price Equity Income ETF | $102,515,403 | $4,896,815 | 8.71 | 13,634 | T Rowe Proxy | Virtu | 0.54% |

| TGRW | 8/5/20 | T. Rowe Price Growth Stock ETF | $49,452,803 | $2,986,435 | 10.01 | 6,179 | T Rowe Proxy | RBC | 0.52% |

| TSPA | 6/8/21 | T. Rowe Price U.S. Equity Research ETF | $28,396,240 | $1,295,083 | 10.26 | 2,992 | T Rowe Proxy | RBC | 0.34% |

| IVRA | 12/22/20 | Invesco Real Assets ESG ETF | $3,070,743 | $0 | 45.84 | 899 | Fidelity Proxy | Citadel | 0.59% |

| LOPP | 2/1/21 | Gabelli Love Our Planet & People ETF | $12,648,315 | -$603,375 | 32.24 | 292 | ActiveShares | GTS | 0.00% |

| GGRW | 2/16/21 | Gabelli Growth Innovators ETF | $2,645,020 | $0 | 49.46 | 89 | ActiveShares | GTS | 0.90% |

| GAST | 1/5/22 | Gabelli Asset ETF | $4,857,930 | $0 | 35.29 | 13 | ActiveShares | GTS | 0.00% |

| GABF | 5/11/22 | Gabelli Financial Services Opportunities ETF | $6,601,855 | $690,385 | 24.22 | 350 | ActiveShares | GTS | 0.04% |

| GCAD | 1/3/23 | Gabelli Commercial Aerospace & Defense ETF | $3,993,885 | $1,391,375 | 24.44 | 681 | ActiveShares | GTS | 0.00% |

| FRTY | 3/1/21 | Alger Mid Cap 40 ETF | $26,753,750 | -$4,023,750 | 49.86 | 10,493 | ActiveShares | Virtu | 0.60% |

| ATFV | 5/4/21 | Alger 35 ETF | $13,483,750 | $2,888,000 | 60.62 | 2,185 | ActiveShares | Virtu | 0.55% |

| AWEG | 3/7/23 | Alger Weatherbie Enduring Growth ETF | $4,138,000 | $2,826,625 | 66.02 | 2,487 | ActiveShares | Virtu | 0.65% |

| CLIA | 5/9/23 | Veridien Climate Action ETF | $2,698,450 | $2,512,153 | 52.26 | 7,119 | ActiveShares | GTS | 0.85% |

| REIT | 2/26/21 | ALPS Active REIT ETF | $18,200,399 | $739,300 | 35.41 | 3,338 | Blue Tractor | GTS | 0.68% |

| STNC | 3/16/21 | Hennessy Stance ESG Large Cap ETF | $45,188,700 | $687,686 | 33.36 | 2,587 | Blue Tractor | GTS | 0.85% |

| DYTA | 3/30/23 | SGI Dynamic Tactical ETF | $93,452,500 | $91,852,575 | 15.74 | 67,096 | Blue Tractor | GTS | 0.95% |

| PFUT | 5/26/21 | Putnam Sustainable Future ETF | $166,200,085 | $142,986,788 | 29.13 | 12,435 | Fidelity Proxy | Virtu | 0.64% |

| PLDR | 5/26/21 | Putnam Sustainable Leaders ETF | $367,598,095 | $315,062,903 | 10.24 | 143,040 | Fidelity Proxy | RBC | 0.59% |

| PGRO | 5/26/21 | Putnam Focused Large Cap Growth ETF | $32,341,671 | $16,895,450 | 9.40 | 8,893 | Fidelity Proxy | RBC | 0.55% |

| PVAL | 5/26/21 | Putnam Focused Large Cap Value ETF | $168,473,642 | $29,774,102 | 30.16 | 24,243 | Fidelity Proxy | Virtu | 0.55% |

| HFGO | 11/9/21 | Hartford Large Cap Growth ETF | $92,429,910 | -$688,095 | 28.71 | 2,868 | Fidelity Proxy | Citadel | 0.59% |

| SEMI | 3/30/22 | Columbia Seligman Semiconductor and Technology ETF | $20,263,013 | $1,786,925 | 26.44 | 2,166 | Fidelity Proxy | Virtu | 0.75% |

| CAPE | 4/5/22 | DoubleLine Shiller CAPE U.S. Equities ETF | $271,943,980 | $29,510,800 | 13.99 | 39,964 | ActiveShares | Citadel | 0.65% |

| FMCX | 4/25/22 | FMC Excelsior Focus Equity ETF | $78,808,500 | -$289,400 | 16.91 | 259 | ActiveShares | GTS | 0.70% |

| BYRE | 5/19/22 | Principal Real Estate Active Opportunities ETF | $5,410,631 | $436,840 | 25.80 | 430 | Fidelity Proxy | Virtu | 0.65% |

| Total/Average | $7,033,821,107 | $1,056,917,055 | 21.64 | 1,119,630 | 0.58% |

Source: Factset & NYSE Internal Database and Consolidated Tape Statistics as of 6/9/2023

*Simple average

Get NYSE's Active ETF Updates

ETF Central

Looking for data, insights, and commentary on the active ETF market? Visit ETFCentral.com to hear directly from experts across the ETF community and access their intuitive ETF and Segment screener to find what’s resonating with investors.