The NYSE Advantage

Published

June 3, 2025

Author

Stefanos Bazinas

Head of Research & Analytics, NYSE

The five trading days between April 3rd and April 9th marked a period of unprecedented volatility in US equity markets. All five trading days landed in the top ten highest volume days in history, including three distinct record-setting days capped by a record 30.98 billion shares on April 9th as the S&P 500 rallied 9.5%. The NYSE Group handled over 1 trillion messages on multiple days, a new all-time high. This time period provided an ideal framework to evaluate the advantages for companies listed on the NYSE during volatile trading conditions.

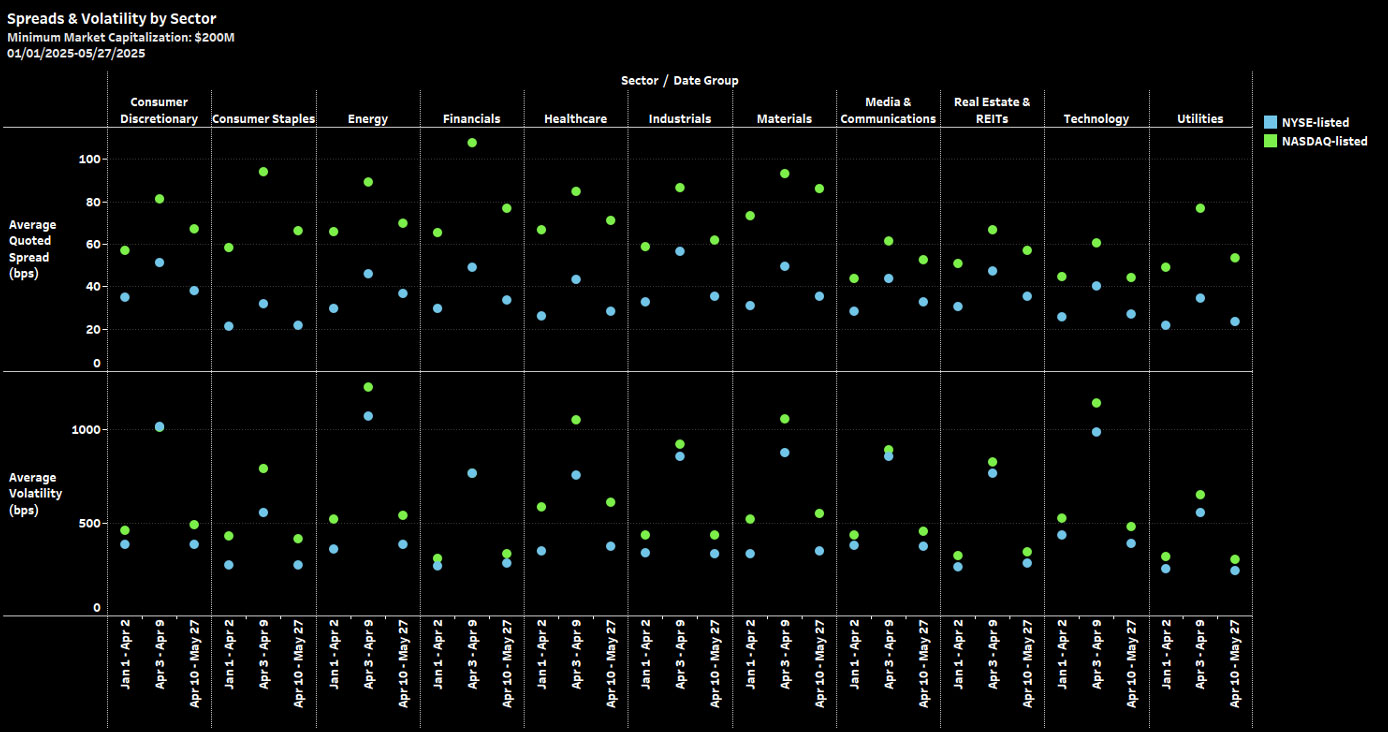

Superior market quality across the board

The NYSE continued to demonstrate superior market quality to rival exchanges. Daily quoted spreads and volatility for NYSE-listed stocks remained significantly lower than those of Nasdaq-listed ones across all sectors during this period of heightened market-wide volatility, quickly reversing back to their average levels shortly thereafter. The NYSE trading model, purpose-built for volatility, once again outshined its peers.

Limit Up - Limit Down (LULD) Halts

First introduced on a pilot basis in 2012, LULD halts have been a permanent feature of US equities market since 2019 and provide a particularly useful tool to analyze an exchange’s volatility dampening mechanisms. Put simply, LULD halts are triggered on a stock-by-stock basis if price volatility breaches a pre-defined threshold. Once triggered, LULD halts remain in effect for a minimum of five minutes and until the Primary Listing Exchange can re-open trading in that security. During a LULD halt, all trading in the halted stock - across all trading venues - is suspended.

The NYSE’s state-of-the-art technology, trading model and auction mechanisms provide an innate advantage to NYSE-listed symbols in absorbing market volatility versus Nasdaq-listed symbols. On Nasdaq’s electronic re-opening auctions, LULD halts are automatically and indefinitely extended in five-minute increments if price volatility remains high. On the NYSE, DMM liquidity obligations act as a buffer in minimizing LULD halts, while DMM-facilitated auctions provide the flexibility required to avoid fixed-interval extensions when halts occur.

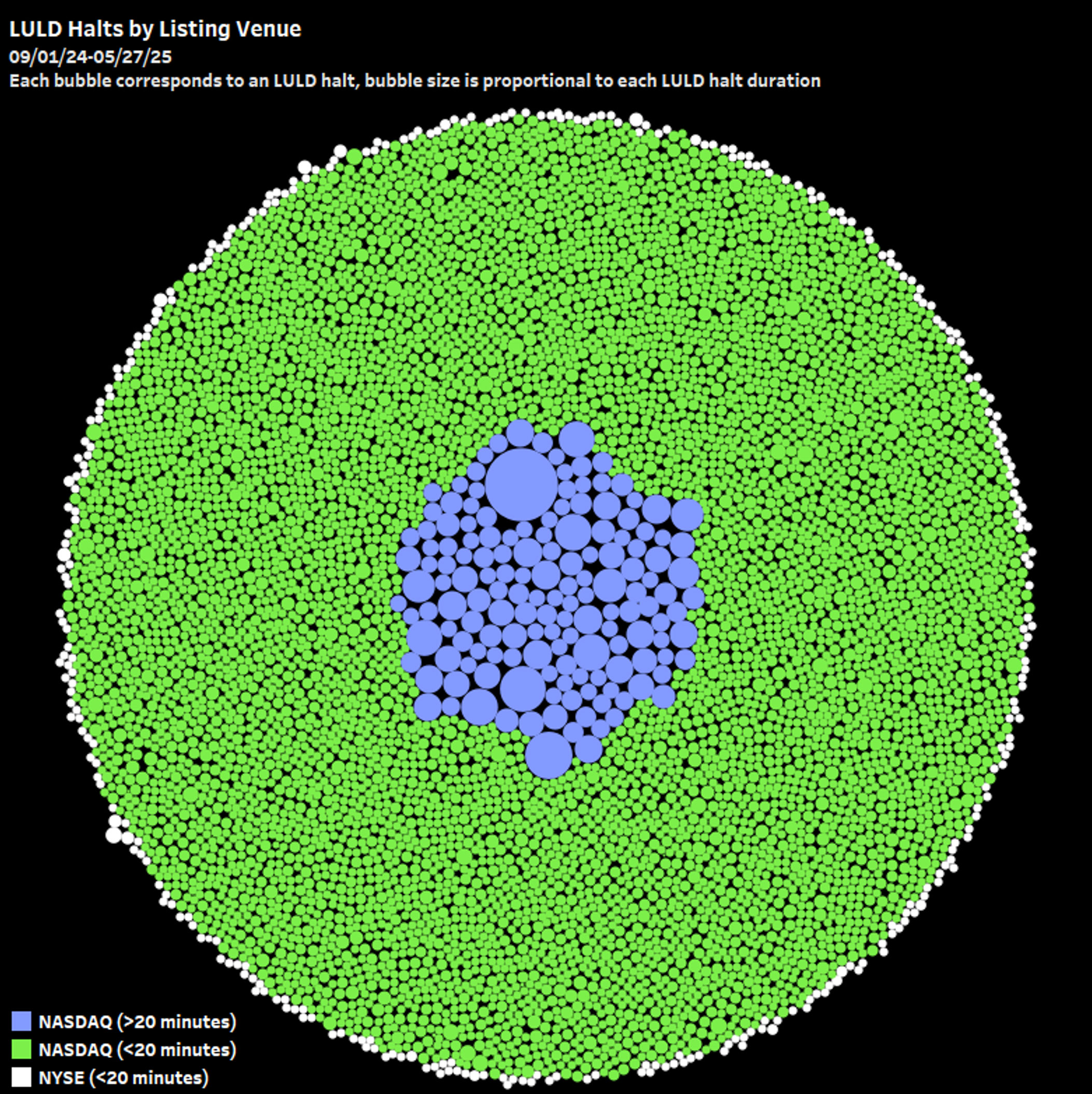

The data speaks for itself. Nasdaq had a total of 334 LULD halts during the period 4/3-4/9, over 13 times more than NYSE’s 25 halts, with the average halt lasting over one minute longer on Nasdaq (7m 23s vs 6m 16s). The longest Nasdaq LULD halt lasted for over one hour of trading, compared to under 19 minutes for the longest on the NYSE.

The NYSE remained LULD halt-free for at least 90% of the core trading session on each of these five trading days, whereas Nasdaq failed to have a single day at least 60% halt-free. In fact, Nasdaq had at least one active LULD halt for 97.5% of the core trading session on 4/8 and was halt-free for a mere 10 minutes.

Although the NYSE advantage shines the brightest during periods of extreme volatility, this outperformance is an everyday phenomenon. Since Q3 2024, not only has Nasdaq triggered a total of 7,469 LULD halts on its listed stocks compared to just 329 for the NYSE, but those halts have also lasted multiple minutes longer on average and hours longer at the maximum for Nasdaq-listed vs NYSE-listed symbols. This disparity remains clear across all groups of company market capitalizations. In fact, just looking at companies in the largest market capitalization group (over $10B), there were almost three times as many LULD halts for the Nasdaq-listed vs NYSE-listed stocks.

The NYSE model maximizes uninterrupted trading, achieving LULD halt-free operation for 97% of the trading time. The same cannot be said about Nasdaq-listed symbols, where frequent and long LULD halts disrupt trading and exacerbate market volatility a third of the time.

Zeroing in on IPO days, although IPO-day volatility is sometimes unavoidable due to market demand, NYSE-listed symbols still show less disruption on these critical trading days. Looking at IPO days since Q3 2024, the NYSE has triggered a total of 13 LULD halts on just 2 distinct occasions, compared to 312 halts across 75 IPO days on Nasdaq.

Why halts matter to listed companies

1. Availability of Trading

No trading on any venue can take place during an LULD halt. The more frequent and the longer the pause, the more missed opportunities for market participants to interact with available liquidity and enhance price discovery.

2. Snowball Effect

Frequent and long LULD pauses deter market participants from providing and/or interacting with liquidity in a stock, thus widening spreads and further exacerbating idiosyncratic symbol-specific volatility.

3. Liquidity Events

LULD pauses on major market liquidity events (e.g. rebalance days, earnings announcements) remove liquidity from the table as investors are unable to trade on some of the most important trading days of the year.

Listing on the NYSE comes with all the benefits of the NYSE model which minimize market volatility and seek to best ensure trading remains uninterrupted. Why list anywhere else?

Why list on the NYSE?

NYSE Research Insights

Find all of NYSE Research's articles on market quality, market structure, auctions, and options.